The crypto market saw a sudden drop downwards which led to millions of dollars punted by leveraged traders getting liquidated.

March 31, 2021 at 11:27 am UTC · 2 min read

Crypto traders were in for a tough surprise on Wednesday morning after a sudden market drop caused over $663 million worth of losses stemming from margin trading, data from markets tool Bybt shows. 88% of all liquidations occurred on ‘long’ positions.

Margin trading is the process via which traders borrow excess capital from their brokers (or exchanges) to either place bigger bets than their capital or to manage risk.

The brokers, in turn, charge a fee as interest and automatically close out positions at a predetermined price level to manage their risk. The trader’s entire capital is then essentially lost and the position is said to be liquidated.

Liquidation insights

As per Bybt, over 151,438 traders were liquidated in the past 24 hours—the total liquidations reached $970 million—and the largest single liquidation order was a BTC trade worth $14.68 million on crypto exchange Huobi.

Of the $663 million liquidated over the past four hours, over 584.33 million were ‘long’ positions, or traders betting on higher asset prices, while $79 million were ‘short’ positions, or traders betting on lower prices.

Traders on Binance saw the biggest hits with over $400 million worth of positions getting liquidated. Futures exchange Bybit followed that with over $145 million in liquidations, while Huobi saw $124 million in liquidations.

On the lower side were crypto exchanges Deribit and Bitfinex, which saw relatively smaller $853,000 and $574,000 in margin positions getting liquidated respectively.

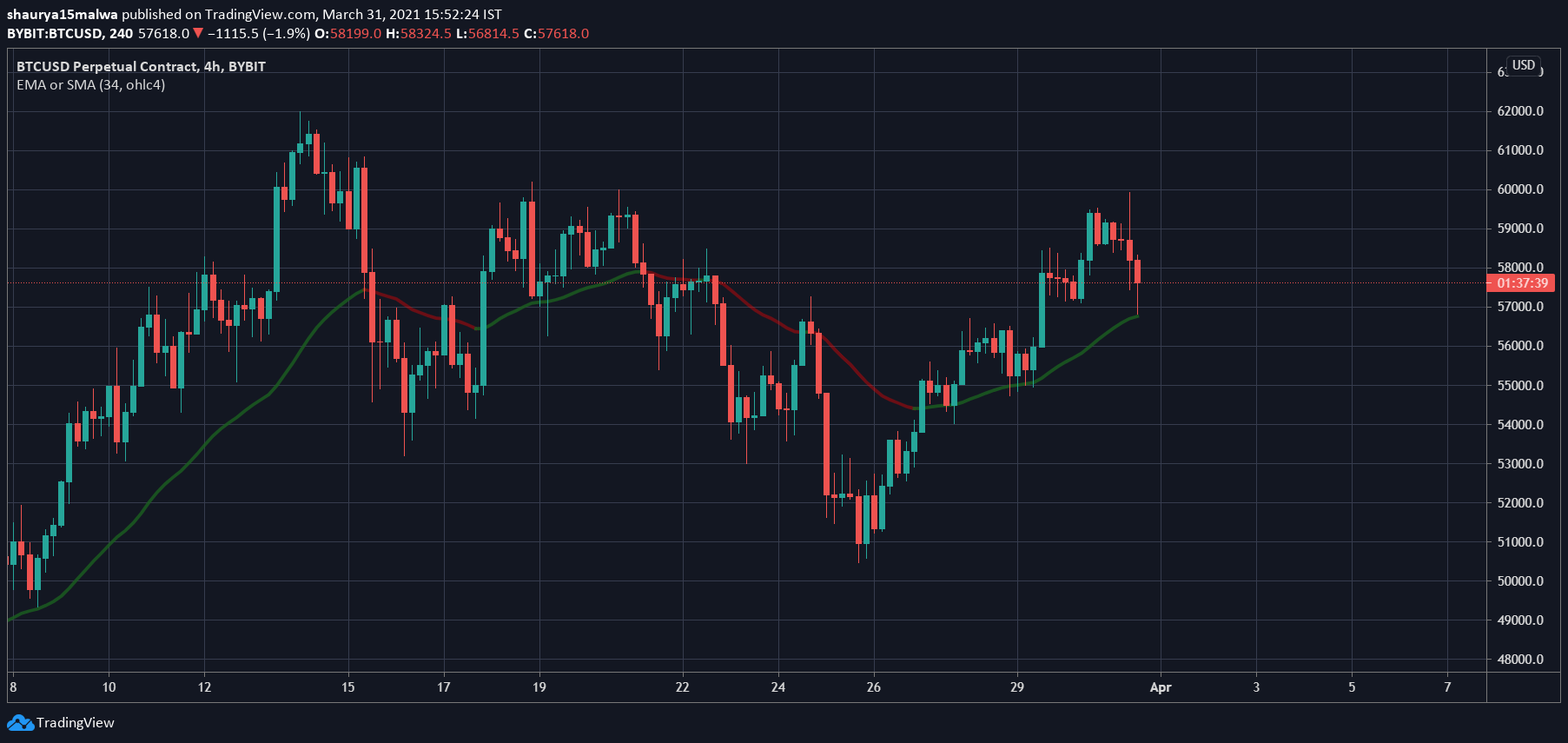

As the below image shows, Bitcoin fell to as low as $56,880 before being aggressively bought up by traders, suggesting the move was more technically driven than having a fundamental rationale behind it. But that led to over $389 million in Bitcoin traders getting liquidated in the past four hours.

Meanwhile, the asset was followed by liquidations on $73 million worth of Ethereum (ETH) positions, $22 million of Binance Coin (BNB), and $11 million worth of Theta Network (THETA) positions. It’s a degen market indeed.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link