Popular analyst Will Clemente believes that Bitcoin could trend higher in the coming months as on-chain data flash bullish signals.

The prominent on-chain strategist tells his 209,100 followers that he’s closely watching Bitcoin’s illiquid supply relevant strength indicator (RSI). The indicator follows the momentum of Bitcoin accumulation by running the 365-day stochastic RSI over the 30-day net change of BTC illiquid supply.

“This wave of Bitcoin supply shock has the most momentum of any in recent history. We’re going much higher over the coming months.”

According to Clemente’s chart, Bitcoin tends to ignite a parabolic ascent every time the metric travels from the bottom to the top of the range, or the area where a BTC supply-side crisis could be in play. It happened in the second half of 2020, in the first half of 2019 and the latter half of 2017.

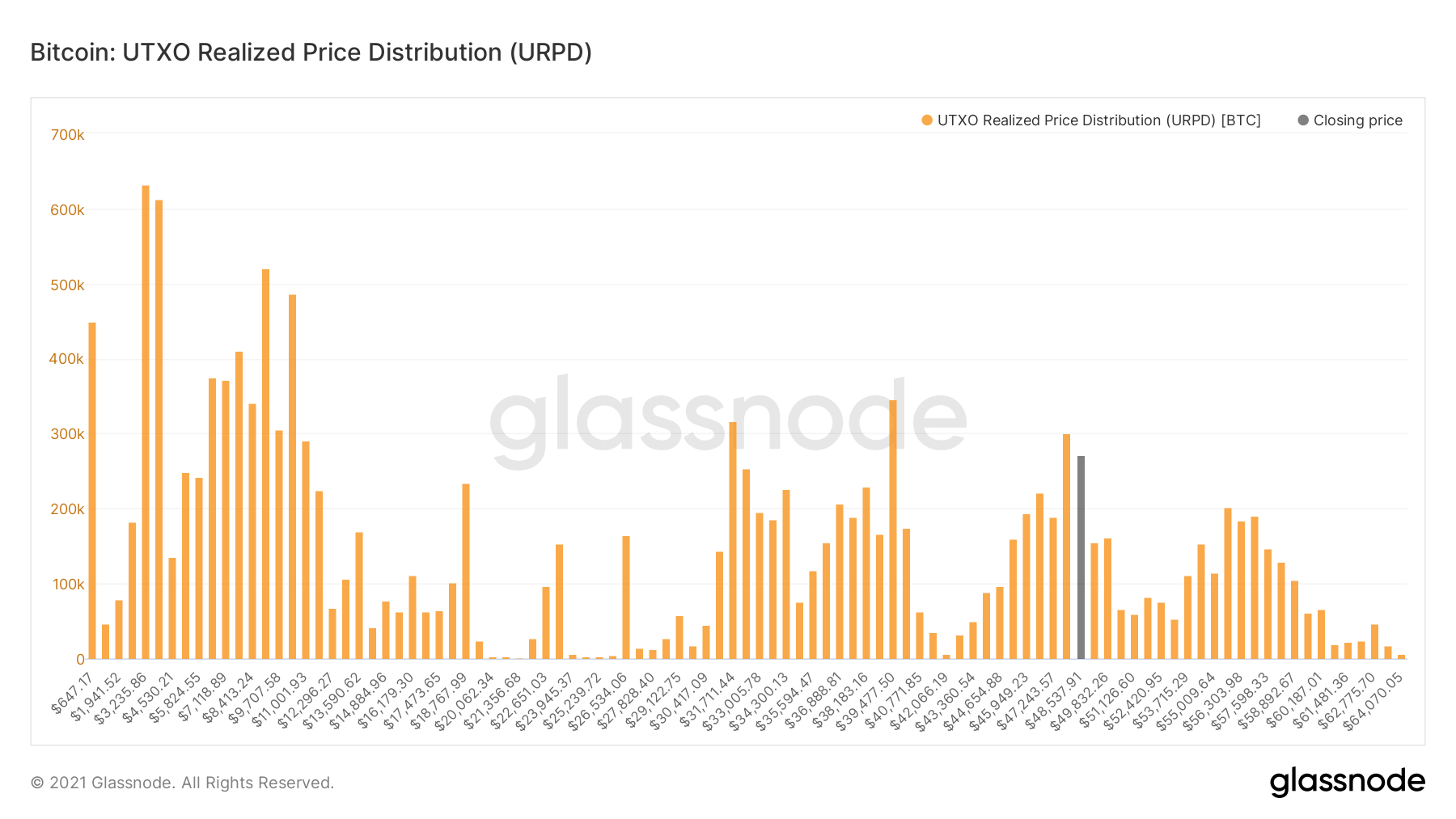

Should Bitcoin ignite a rally, Clemente highlights that $48,000 could act as a tough on-chain resistance. Above that, the next on-chain resistance stands at $55,000.

“Air between $50,000 and $54,000. Blue skies above $60,000.”

On July 5th, when BTC was trading around $33,000, Clemente predicted that a BTC supply shock could push prices higher. The value of BTC has surged over 40% since, with Bitcoin now trading around $47,000.

Clemente also previously said that this cycle could be different from all other bull markets as long-term holders, or BTC owners who have kept their coins dormant for at least five months, are accumulating at a rapid rate.

“Structurally, this time actually is different. Long-term Bitcoin holders set the floor.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/3000ad

Credit: Source link