During the second week of October, the total value locked (TVL) in decentralized finance (defi) protocols crossed $200 billion, and two weeks later in November, the TVL in defi surpassed $250 billion gaining 25% in value. Meanwhile, Ethereum commands more than 67% of the $253 billion TVL in defi today, gaining 4.65% during the last seven days while Solana’s TVL increased by 5.99% this past week.

Defi TVL Increases by 25% in 2 Weeks

The total value locked (TVL) in defi has reached an all-time high, tapping $253.94 billion on November 3, 2021. On October 12, Bitcoin.com News reported on the defi TVL surpassing $200 billion and in two weeks the value has expanded by 25%. Value expansion is not only due to more value being added to defi protocols, but crypto assets like ethereum (ETH), solana (SOL), and avalanche (AVAX) have seen significant gains. Today, the TVL on the Ethereum blockchain is 67% or $171.24 billion, according to defillama.com stats.

The second-largest defi blockchain in terms of TVL is the Binance Smart Chain (BSC) with $19.5 billion, which is 7.707% of the entire defi TVL today. Solana’s TVL, which increased by 5.99% this past week, is $14.12 billion on Wednesday, which is 5.58% of the aggregate in defi. Tron saw a large increase of 28.9% as the blockchain’s defi TVL is $6.11 billion. The Arbitrum One chain has jumped to all-time highs with $2.69 billion TVL, up 16.19% during the course of the trailing week.

Defi Report Shows Binance Smart Chain, Ethereum, Polygon Daily Transactions Rise

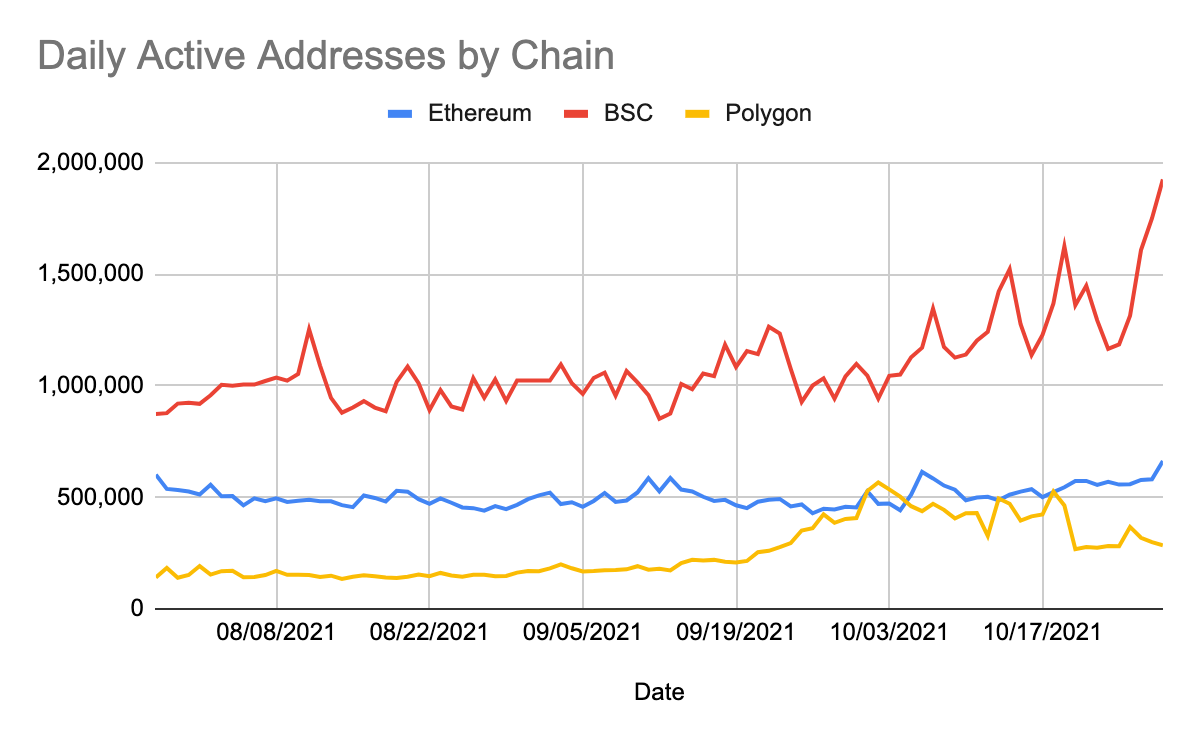

The “Defi Weekly Report” series published by Coin98 Analytics indicates that the BSC decentralized exchange (dex) Pancakeswap has reached “600,000+ daily active users.” Moreover, the 43rd Coin98 Analytics’ defi report notes that BSC active addresses tapped 1.9 million wallets per day. The researchers detail that alongside the increase of active addresses, BSC also saw a spike in daily transactions.

“The daily transactions [from the] Binance Smart Chain increased in line with the number of daily active addresses, reaching 10.8 million transactions this week,” the 43rd Coin98 Analytics’ defi report details. “Ethereum and Polygon are also showing signs of growth in daily transaction volume this week as Ethereum hit 1.5 million transactions/day (+18.26%) and Polygon reached 4.6 million transactions/day (+39.94%),” the researcher’s study adds.

Curve, Uniswap, Quickswap, Trader Joe Defi Activity Expands

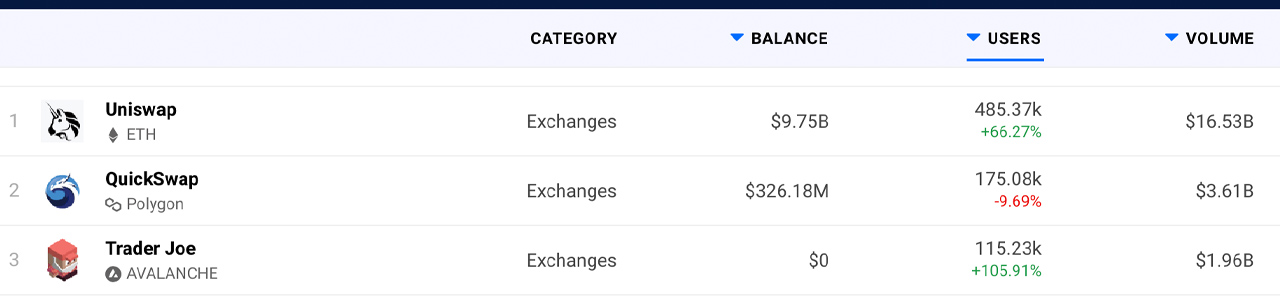

On Wednesday, the defi protocol Curve recorded a seven-day increase of 9.28%, with Curve’s TVL at $19.94 billion. Curve has a dominance of 7.87% according to today’s metrics and the dex supports seven different blockchains. The largest dex in terms of swap volumes is Uniswap during the last 30 days with $16.53 billion in global trade volume.

Polygon’s (MATIC) popular dex protocol, Quickswap, has seen $3.61 billion in global trade volume during the last months. The Avalanche-based dex Trader Joe is the third-largest in terms of 30-day volume with $1.96 billion, according to dappradar.com’s decentralized exchange rankings.

What do you think about the overall increased activity and value in the land of decentralized finance right now? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, dappradar.com, Coin98 Analytics, defillama.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link