Bloomberg Intelligence’s senior commodity strategist Mike McGlone says crypto may have one big advantage over the stock market.

The closely followed strategist compares the S&P 500 to the MVIS CryptoCompare Digital Assets index which tracks the performance of the 10 largest and most liquid digital assets. According to McGlone, the ability of digital assets to shake out excess leverage from the system with sudden plunges and rebounds is one advantage crypto has over the equities market.

“It’s almost guaranteed that the Federal Reserve will expand easing the next time the stock market wobbles, if past patterns hold, which should solidify underpinnings for Bitcoin. A cleansing of speculative excesses in 1H (1 hour) may be an advantage crypto assets have over the S&P 500.”

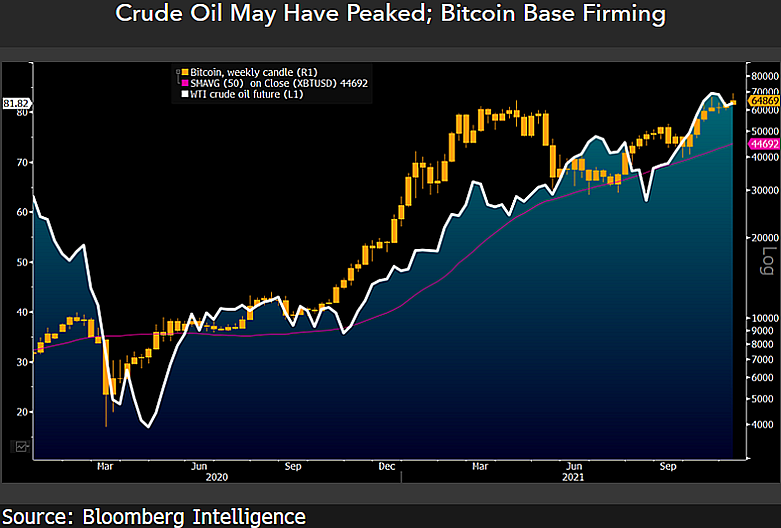

Looking at Bitcoin, McGlone says that BTC continues to build a solid base as prices of crude oil and commodities show that peak inflation is in sight.

“Crude oil and commodities are good indicators that peak inflation is near. We believe crude is fundamentally a bear market bumping against the upper end of its price range since the 2014 plunge. Bitcoin is becoming digital collateral and part of the technology revolution.”

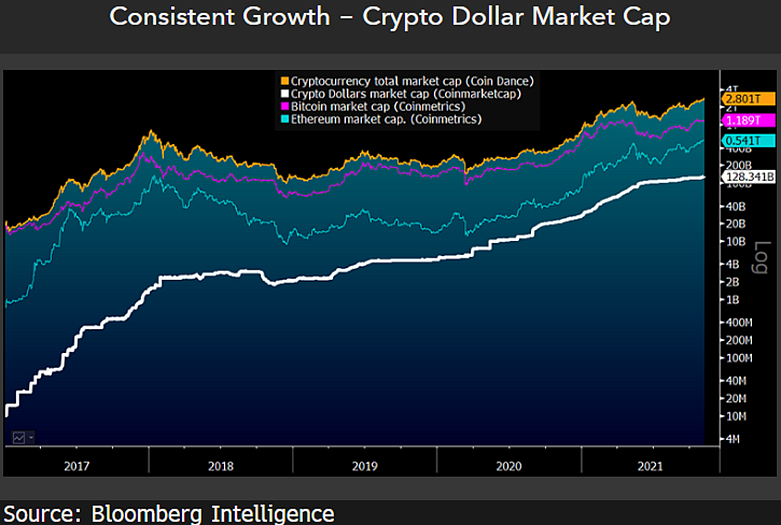

McGlone also highlights the three main components driving the growth of the crypto markets, which include Bitcoin, Ethereum (ETH), and the vast amount of stablecoins, which he refers to as “crypto dollars.”

“Three crypto musketeers driving $3 trillion market cap – representing a better way to transact, a strengthening ecosystem and here-to-stay asset class, crypto dollars are the most significant advancing part of the digital-money revolution and the third leg of the crypto stool.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/West Coast Scapes

Credit: Source link