Crypto analytics firm Santiment says that the market’s latest crash is stirring up investor interest in “buying the dip.”

The market insights agency tells its 114,000 Twitter followers that Bitcoin (BTC) and Ethereum (ETH) are seeing their prices find support thanks to the highest instances of “buy the dip” mention on social media seen since early September.

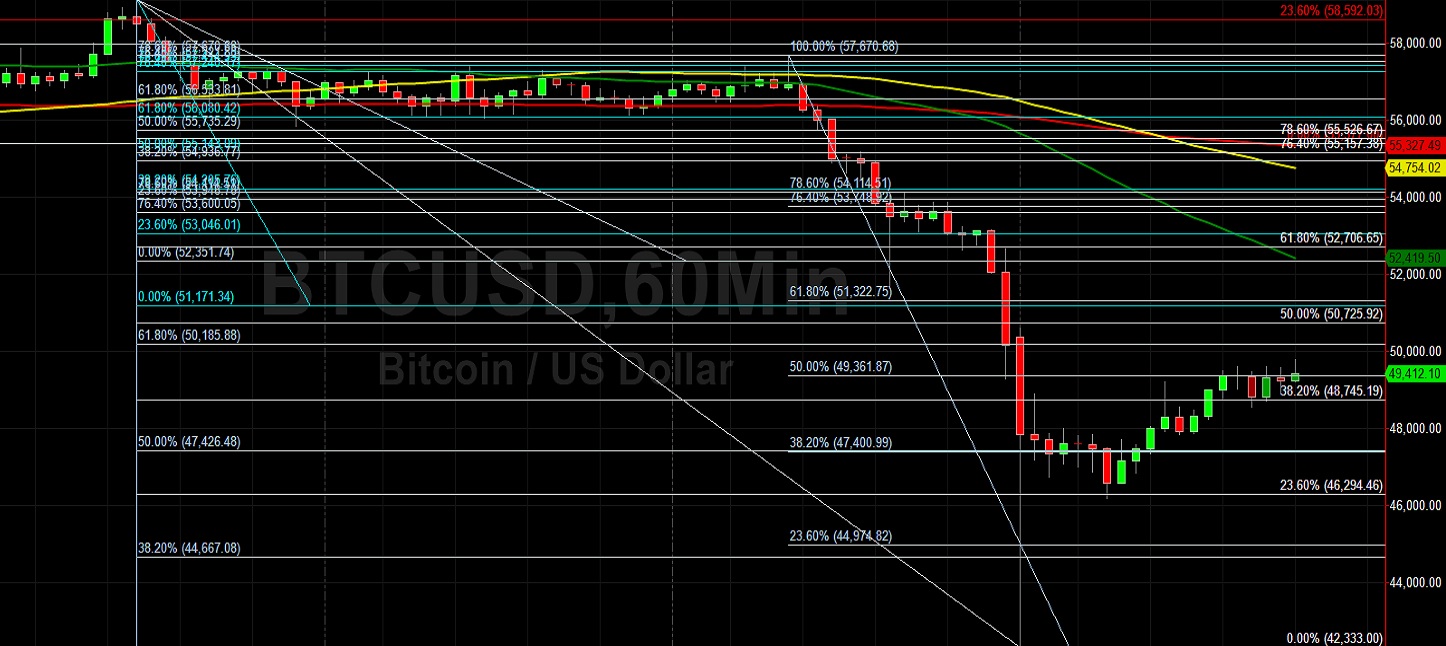

“Bitcoin fell all the way to $43,500 about an hour ago, along with Ethereum dropping to $3,540. However, prices are bouncing with the largest ‘buy the dip’ interest spike in 3 months.”

Santiment notes that with the exception of three decentralized finance (DeFi)-focused coins, the entire list of top 100 cryptos bled significantly on the day of the market meltdown, which saw roughly $600 billion get shaved off the digital asset market.

The crypto insights firm says market catalysts to keep an eye on include sentiment towards the Covid-19 pandemic, as well the ratio between longs and shorts.

“With the exceptions of ATOM, NEAR, and DFI, the top 100 largest assets in crypto were universally in the red. This weekend, important factors to watch are global pandemic fears, and the ratio between traders buying the dip and shorting markets.”

One entity that publicly bought the dip was the nation of El Salvador. The country’s president, Nayib Bukele, announced the purchase on Twitter.

“El Salvador just bought the dip!

150 coins at an average USD price of ~$48,670″

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/KDdesignphoto

Credit: Source link