During a fireside chat with its community, Robinhood co-founder and CEO Vlad Tenev shared insights into what his company’s position on crypto is. According to Tenev, in less than two months, over six million new users traded cryptocurrency on the platform, based on statistics they pulled for the month of February.

“We want to make a huge investment and hire a ton of people,” Tenev shared in the video, adding that Robinhood is “going to try and get that done as fast as possible. We might add some new coins along the way.”

Tenev said that alongside the cryptocurrencies already available for trading on the platform, the company is on its way to develop and add support for other cryptocurrencies, with a compatible crypto wallet already under development. “As much as people are bugging me on that on social media, I’m bugging our crypto team and our software engineers,” Tenev said in jest. The company is on its way to an IPO, and the business is currently running with a valuation of as high as $40 billion.

This surge and exponential growth of usage on the part of platforms like Robinhood and its competitors is a critical issue. When companies of this size scale up their service reach, there is a possibility of blacking out access and reducing the reliability of its services in order to expand its reach. With this said, Tenev assured the asking audience that Robinhood is prioritizing an “A+ level” of service availability and support.

Robinhood began trading cryptocurrencies in 2018, but it wasn’t until 2020 that the platform’s crypto division (Robinhood Crypto) began to gather steam and begin active cycles, with about 200,000 customers using the platform to trade crypto.

“The reason I think we ultimately decided to do it is there is a use case for people that don’t want to manage their own coins and just want to treat it as an investment,” said Tenev in the fireside chat. “That said, we want to give people the option [to control their crypto assets] for sure.”

Once Robinhood fully expands its suite of available crypto assets, it will offer a unique way to do commission-free investing, as compared to other platforms like Coinbase, the largest cryptocurrency exchange in the U.S., which charges a commission of one-half of one percent (0.50%) for cryptocurrency purchases and sales.

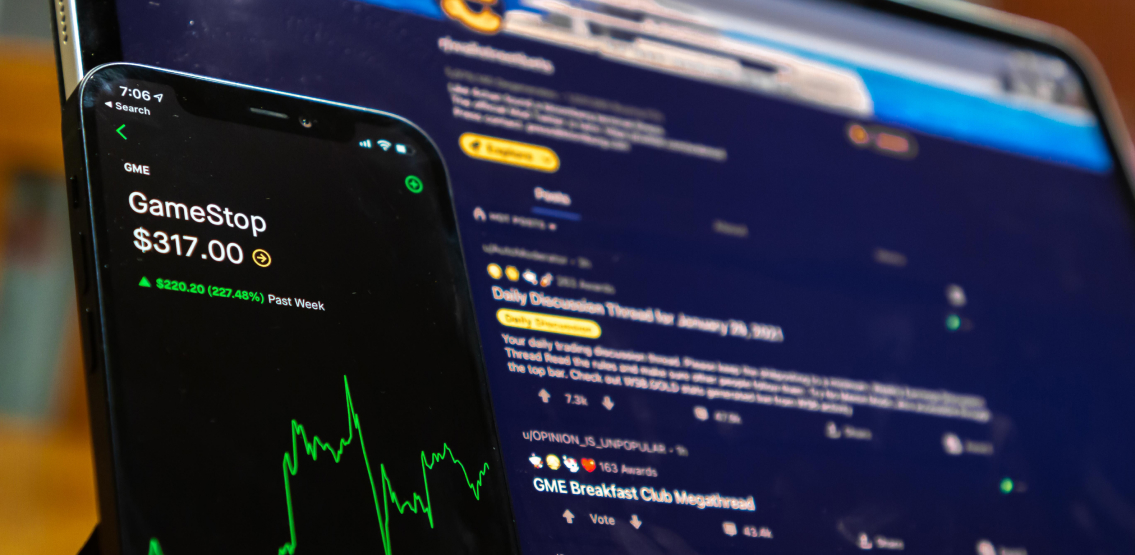

Recent issues like the rise of Dogecoin and the Congressional hearings on GameStop brought Robinhood to negative light, and until now, the company is still recuperating from the negative press due to its involvement with the latter wherein it halted trading for these assets on its platform.

It was highlighted that, as itself a brokerage, Robinhood receives compensation for directing trade execution to third parties, which are usually higher-frequency trading firms. The decision to do so revealed Robinhood’s lack of transparency for its order flow practices, an important aspect of trading that seasoned crypto investors and traders often look into before they buy in or sell.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Credit: Source link