Bitcoin (BTC) tumbled by 9.08% in the last 24 hours to trade at $49,262 at the time of writing, according to CoinMarketCap. This price slump resulted in the leading cryptocurrency dipping below the psychological mark of 50k after hitting record-highs of more than $64k in the recent past.

Market analyst Joseph Young believes that fear is causing this drop in the BTC market. He explained:

“Fear in the Bitcoin market caused by $4 billion liquidated, Kimchi Premium hitting 0% now slightly above 4%, small to midsize whales selling, and Biden tax concerns. Waiting for the leverage to go down a bit and then a solid recovery.”

Young acknowledged that Bitcoin price could decline a bit further before rallying back upwards.

The shock waves in the Bitcoin market are partly triggered by the speculations that U.S. President Joe Biden’s administration will increase capital gains taxes. As a result, affect investments in digital assets.

This proposal has made American investors in crypto assets panic. For those US investors who have held cryptocurrencies for more than one year, cashing out for selling digital assets will face the risk of high capital gains taxes.

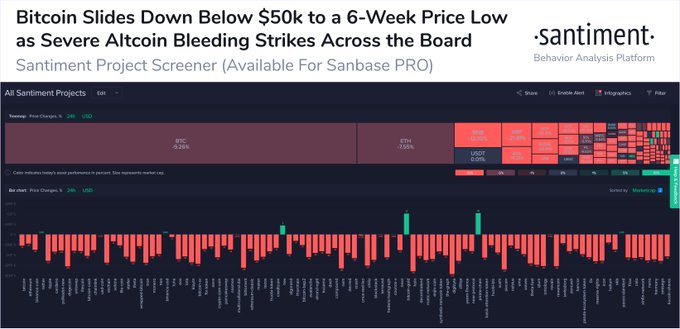

The slackening BTC price has made the top cryptocurrency hit a 6-week low, as acknowledged by on-chain metrics provider Santiment.

Bitcoin’s dominance nosedives

According to crypto data provider Bloqport:

“Bitcoin’s dominance drops to 50.2% for the first time in three years.”

Nevertheless, crypto analyst Michael van de Poppe believes that Bitcoin is calming down because it ran from $10k to $60k without any breaks, and this is healthy.

Other traders and analysts have also alluded to the fact that the BTC price drop is likely temporary as an overwhelming appetite from institutional and retail investors for this digital asset are showing its continued acceptance.

As the clock ticks, time will tell whether Bitcoin will regain its momentum and continue hitting record-highs in 2021.

Image source: Shutterstock

Credit: Source link