According to a leading crypto asset manager, institutional investments in digital asset products have been declining for the second week in a row, suggesting investors are getting cautious.

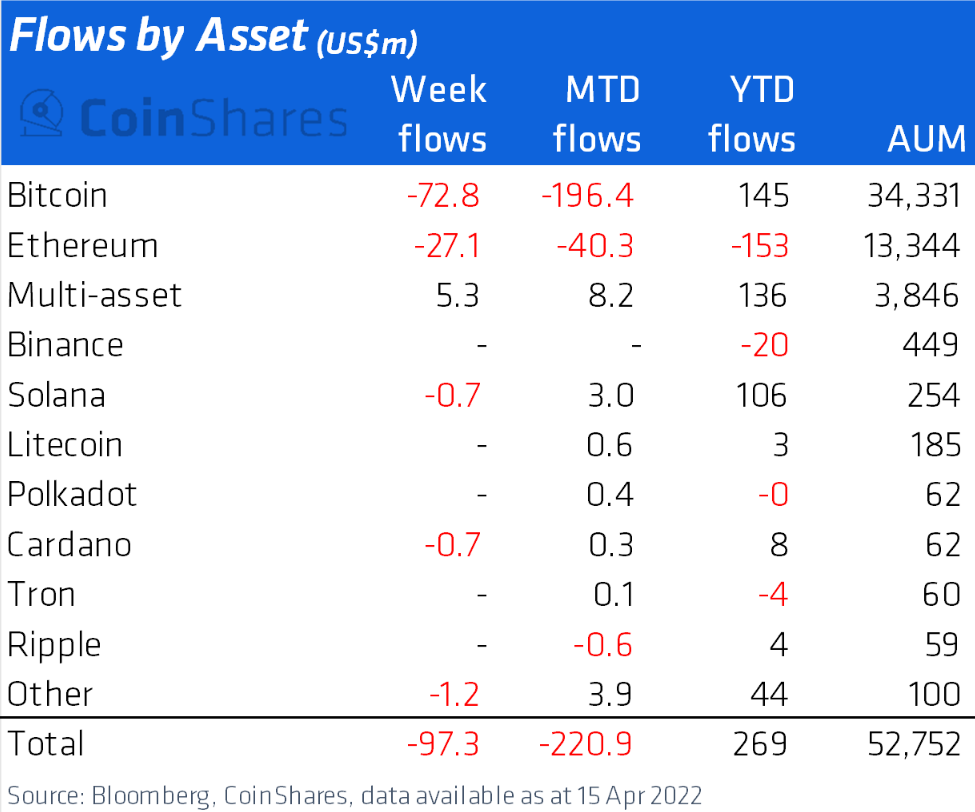

In the latest edition of the Digital Asset Fund Flows Weekly report, CoinShares finds that crypto investment products saw outflows last week totaling nearly $100 million.

“Digital asset investment products saw outflows totaling US$97m last week. The outflows represent the second week in what we believe is likely a result of recent profit-taking and a reaction to the more hawkish FOMC [Federal Open Market Committee] statement.”

CoinShares suggests that last week’s heavy outflows from Europe may be a delayed reaction to the FOMC’s statement in regards to tightening monetary policy.

Leading crypto by market cap Bitcoin (BTC) suffered the heaviest outflows last week, $73 million, to reach $196 million in outflows for April 2022.

Altcoins such as Ethereum (ETH), Solana (SOL) and Cardano (ADA), digital assets whose investment products usually enjoy inflows, followed Bitcoin into outflows last week. Investment products focused on multiple digital assets, or multi-coin assets, were the only products to see inflows last week.

“Ethereum, Solana and Cardano saw outflows last week too, totaling US$27m, US$0.7m and US$0.7m respectively. Multi-asset investment products (multi-coin) remain a firm stalwart with another week of inflows totaling US$5.3m.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Viktory Viktor/Nikelser Kate

Credit: Source link