Seasoned market analyst Peter Brandt is warning Bitcoin traders and investors alike, saying that BTC is poised for a sharp corrective move.

Brandt tells his 636,800 Twitter followers that Bitcoin has broken down from crucial diagonal support that has kept BTC afloat for the first few months of 2022.

“The completion of a bear channel typically results in a decline equal to the width of the channel, or in this case a hard test of $32,000 or so – my guess is $28,000

This does NOT make me a hater BTC.”

At time of writing, Bitcoin is trading at $38,605, nearly 40% away from Brandt’s downside target of $28,000.

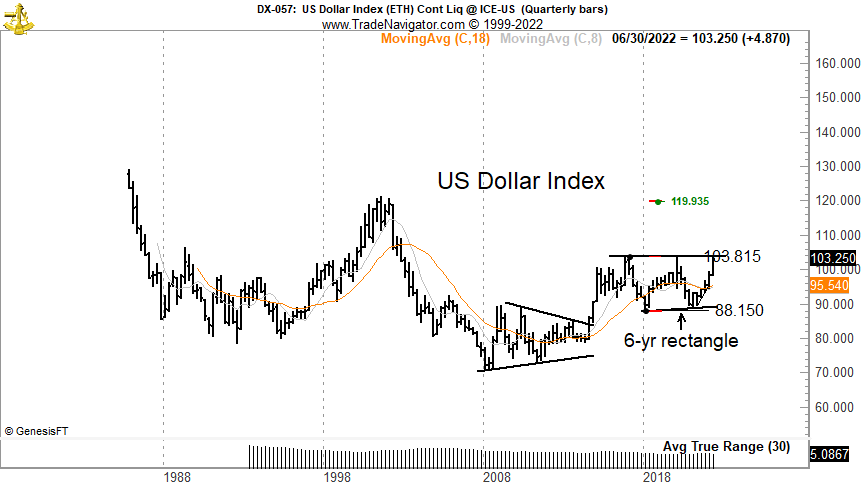

Brandt is also keeping a close watch on the US dollar index (DXY), which pins the USD against a basket of fiat currencies.

According to Brandt, the DXY looks ripe for a massive breakout after trading in a wide range for about six years.

“Compounding the debt squeeze is the fact that global debt is collateralized in USDs and [DXY] is poised to blow through the ceiling.”

Traders often monitor the performance of the US dollar index to gauge market sentiment as a strong DXY suggests investors are selling risk-on assets like crypto to move to the safety of the dollar.

Last month, widely followed analyst Michaël van de Poppe said that a bearish DXY reversal will ignite a strong rally in the crypto markets.

“Still waiting for this one to turn around, then the party of crypto will begin.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/agsandrew

Credit: Source link