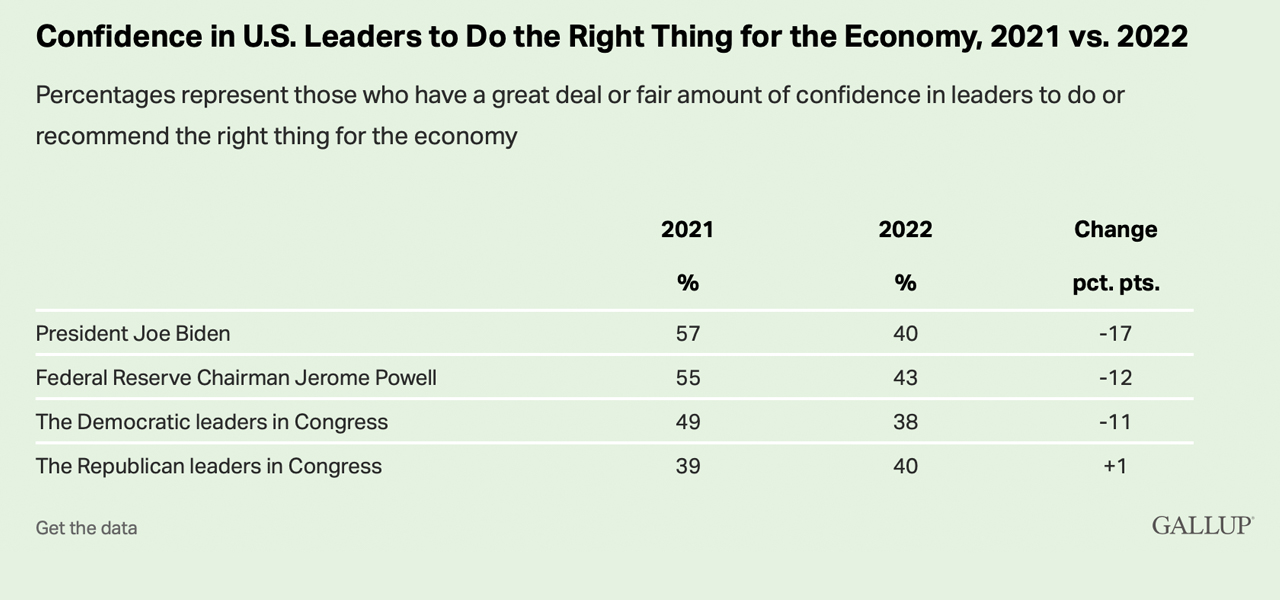

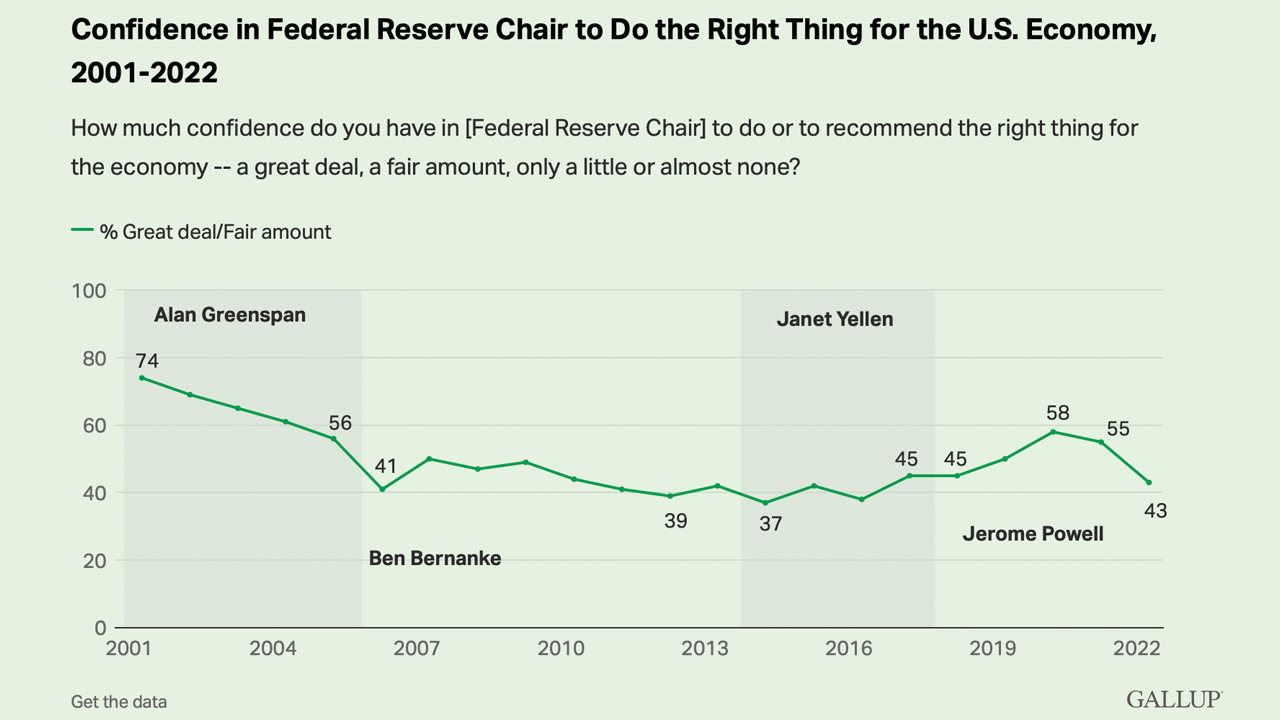

According to a Gallop poll published on May 2, the public’s confidence in America’s current economic leaders has been deteriorating. Confidence in U.S. president Joe Biden managing the U.S. economy has dropped from 57% to 40%, and faith in Federal Reserve chair Jerome Powell has faltered from 55% to 43%. The April 2022 Gallop poll, published amid the highest inflationary pressure the country has seen in decades, indicates trust in economic leaders is at its lowest point since 2008.

Americans Are Not Confident in Current Leaders Managing the Economy

After the largest monetary expansion the country has seen in its entire lifetime, faith in America’s economic leaders is “flagging,” according to a recently published Gallop poll.

The poll was conducted via telephone interviews on April 1-19, 2022, with 1,018 adult U.S. residents. The Gallop poll particpants resided in all 50 states and the District of Columbia. Furthermore, the survey was done before U.S. gross domestic product report, and the recent Federal Reserve rate hike. The Gallop survey authors state:

Public confidence in key U.S. leaders’ management of the national economy is shaken amid the highest inflation rate in more than 40 years and Americans’ increasingly bleak assessments of the national economy and their own financial situations.

Average Americans are not the only ones who believe the Fed and current economic leaders have lost credibility. A number of analysts, financial authors and economists like Peter Schiff, Robert Kiyosaki, Gerald Celente and many others don’t believe the Fed can save the day. As far as the Gallop poll is concerned, “confidence ratings for all leaders are below historical averages for each,” the report’s authors explain.

Powell Says He’s Not Concerned About Credibility, Gallop Poll Shows Faith in Democratic Leaders Is Lower Than the Confidence in Republican Leaders

On May 4, when Fed chair Jerome Powell was asked directly if he was “concerned about Fed credibility with the American people,” Powell said that he was not.

“No. I don’t,” Powell told the Bloomberg Television reporter Mike McKee. “A good example of why would be that, so in the fourth quarter of last year, as we started talking about tapering sooner and then raising rates this year. You saw financial markets reacting. You know, very appropriately.” The Federal Reserve chief added:

Not to bless any particular day’s measure. But the way financial markets, you know, the forward rate curve has tightened in response to our guidance and our actions really amplifies our policy. I mean, its monetary policy is working through expectations now, to a very large extent.

Moreover, Powell also told the Bloomberg reporter that the U.S. central bank decided to choose the June 1 date to “begin letting securities roll off” on a mere whim. “It was just pick a date, you know, and that happens to be that happened to be the date that we picked,” Powell stressed to McKee. “[There] was nothing magic about it. You know, it’s not going to have any macroeconomic significance over time,” he added.

The Gallop poll shows that since U.S. inflation has risen a great deal, “Americans’ confidence ratings for Biden’s and Powell’s economic management declined by double digits.” The poll says less than half of American adults said they have “‘a great deal’ or ‘a fair amount’ of confidence” in Biden’s and Powell’s economic management. Powell scored a 43% and Joe Biden scored an even lower 40%. Moreover, Gallop’s stats indicate faith in Democratic leaders (38%) is currently lower than the trust in Republican leaders (40%) when it comes to managing the U.S. economy.

What do you think about the Gallop poll that shows trust in America’s current economic leaders is lagging? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link