The cryptocurrency economy has shed a lot of value during the last six months dropping 48.70% from $3.08 trillion to today’s $1.58 trillion. While crypto markets looks extremely bearish these days, a few crypto advocates have theorized the bear market will be less harsh this time around. Furthermore, there’s also the rare scenario that bitcoin’s price could reverse and see a triple top even though it’s commonly said in the finance world “there is no such thing as a triple top.”

The Chances of Bitcoin Experiencing a Triple Top Scenario Is Rare, But Could Happen

Five days ago, Bitcoin.com News reported on a theory that describes bitcoin (BTC) prices experiencing a softer bear market than the leading crypto asset’s 80%+ declines recorded in the past. The reasoning behind the theory is because of past bitcoin price peaks and the most recent peaks recorded in May and November 2021.

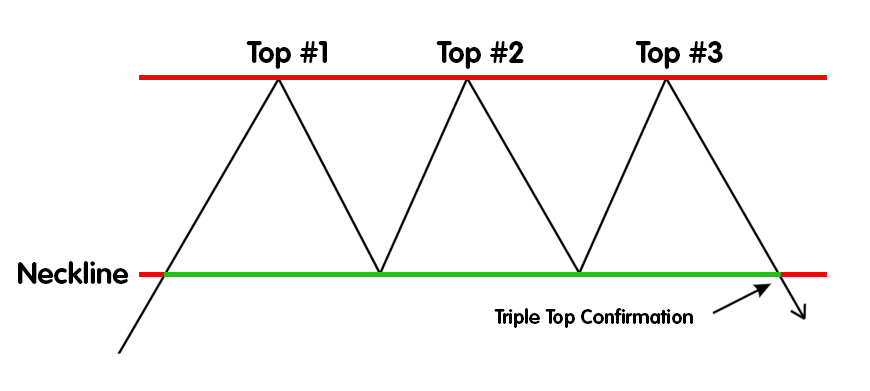

While BTC hit $64K in May and $69K in November, the two peaks were much smaller than previous bull run gains. From the looks of things it seems, BTC’s price experienced what’s called a double top. Now, coinciding with the theory the current market downturn will be a softer bear run, there’s also the rare possibility of a triple top scenario.

Basically, if a triple top scenario takes place, BTC’s fiat value will tap the same resistance it touched during the past downturn. For instance, after BTC tapped a high of $64K in mid-May 2021, the value dropped to a low of $31K on June 21, 2021. From there, the price once again skyrocketed and reached $69K on November 10, 2021.

If a triple-top happens to occur, then the upcoming bottom would be somewhat in the range of the $31K mark, when it starts another reversal. In order for this to happen, BTC will have to see a complete reversal from the same resistance levels and the third top could be equal to and just above or just below the $69K region.

Reversal Theories Considered ‘Hopium’ as Many Won’t Bet on Such a Risky Play

Of course, many will assume theories of a triple top are based on pure faith and “hopium.” In the trading world, triple tops are very rare and quad tops are seemingly non-existent. In 2019, allstarcharts.com analyst JC says: “We rarely see triple tops, and I can’t even tell you if I’ve ever seen a quadruple top. Betting on these outcomes seems to never pay.”

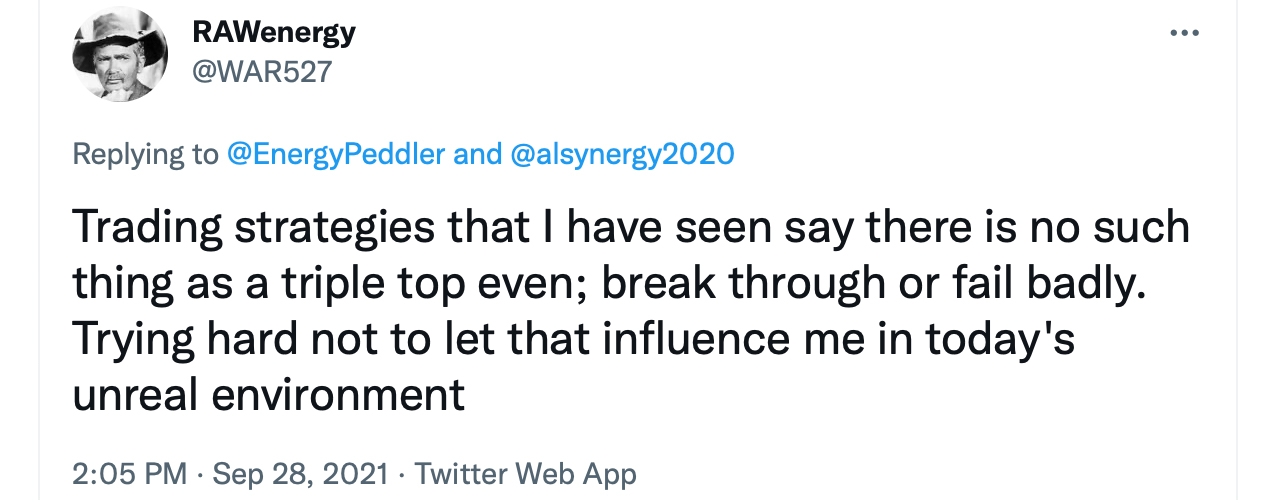

Which means betting on bitcoin (BTC) experiencing a triple top is a very risky bet in comparison to betting on a double top formation. Moreover, its a common message in the trading world to state:

There is no such thing as a triple top.

While it’s common to say the statement, saying “there is no such thing as a triple top,” the comment is not entirely accurate. They surely have occurred in financial market scenarios in the past, and traders who risked betting on them have reaped the rewards. However, when a triple top does execute and complete, the “party is officially over.” When a triple top is executed, the price will begin a bearish descent until the next price cycle regains bullish strength.

While many are likely still willing to bet on a triple top formation as far as bitcoin’s price is concerned, its even more likely they are not willing to bet on a seemingly non-existent quad top. Moreover, triple tops being as rare as they are, means a great deal of traders are not willing to bet a third peak is in the cards. The chance of a BTC triple top coming to fruition is not impossible, and no one can safely say the scenario will not come into play.

What do you think about the chances of bitcoin’s price seeing a triple top formation after hitting the next resistance level? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link