While most cryptocurrency markets are down today in value, dollar-pegged stablecoins have seen significant demand during the last 24 hours. Currently, the entire market valuation of all the stablecoins in existence is roughly $96 billion.

The Rise of Fiat-Pegged Stablecoins

Crypto assets like bitcoin (BTC) and ethereum (ETH) can be volatile and this has caused demand for stablecoins in recent years. Since July 2017, the stablecoin market has swelled considerably but after April 2020, it skyrocketed. One of the main use cases for stablecoins is so people can hedge their funds when crypto prices become extremely volatile.

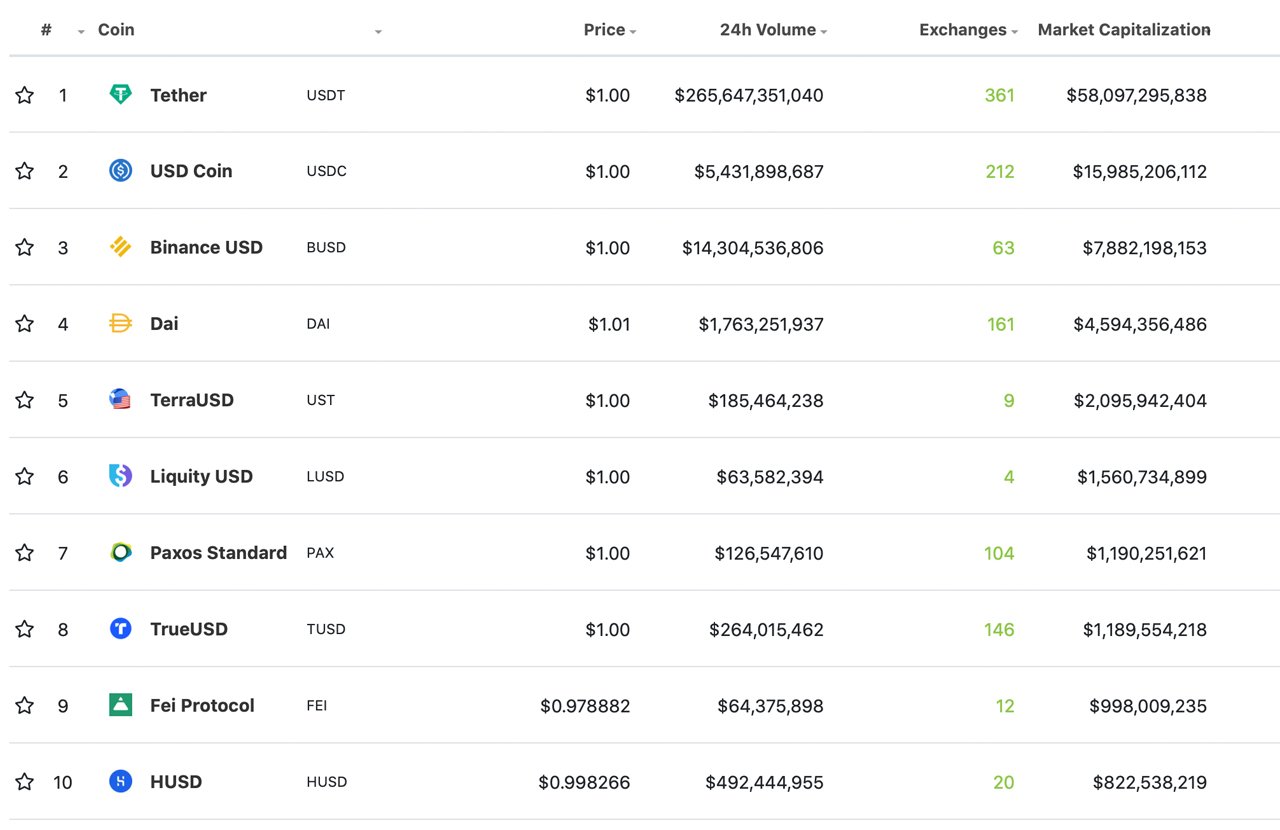

Since the recent market downturn, demand for stablecoins increased dramatically. As most people know, tether (USDT) is by far the largest stablecoin in existence and today it commands a $58 billion market valuation. Tether also captures the most volume, in terms of all the trade volume across the entire crypto economy.

Besides the colossal tether market capitalization, the second-largest stablecoin market valuation in the crypto economy is held by usd coin (USDC). The stablecoin USDC commands a $15 billion market capitalization and has seen $5.4 billion in global trade volume during the course of the last day.

Stablecoin Issued by Binance Gains Traction, Other Crypto-Based Fiat Tokens Swell in Volume and Capitalization

The stablecoin issued by Binance called BUSD or binance usd, has a lower market cap than USDC, and is the third-largest stablecoin by overall valuation. Although, BUSD beats USDC in global trade volume with $14.3 billion in swaps during the last 24 hours.

$14.3 billion in global trades is quite large, but tether (USDT) has seen $265 billion in 24 hours as far as reported volume, according to Coingecko’s “Top Stablecoins by Market Capitalization” aggregator. Stats from messari.io show a similar metric for tether’s reported volume, but “real volume” data from Messari Research shows it may be only $78 billion worth of global USDT trades on Thursday.

Other lesser-known stablecoins have seen volume increases and market caps swell as well. Coins like dai (DAI), terrausd (UST), liquidity usd (LUSD) and paxos standard (PAX) have all seen growth in terms of market caps and trade volume during the last year.

With the entire market valuation of all the stablecoins in existence (48) nearing the $100 billion zone and digital currency prices being as volatile as they are, crypto-based fiat tokens will remain in demand.

What do you think about the stablecoin market cap nearing $100 billion? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link