A widely followed analyst says a relief rally is just around the corner for Bitcoin (BTC) and the crypto markets.

Telling his 102,000 Twitter followers to “send it,” analyst Justin Bennett says the stars are aligning for a crypto rally.

“Odds of a significant relief rally are increasing.

Just need a couple more things to align.

Send it.”

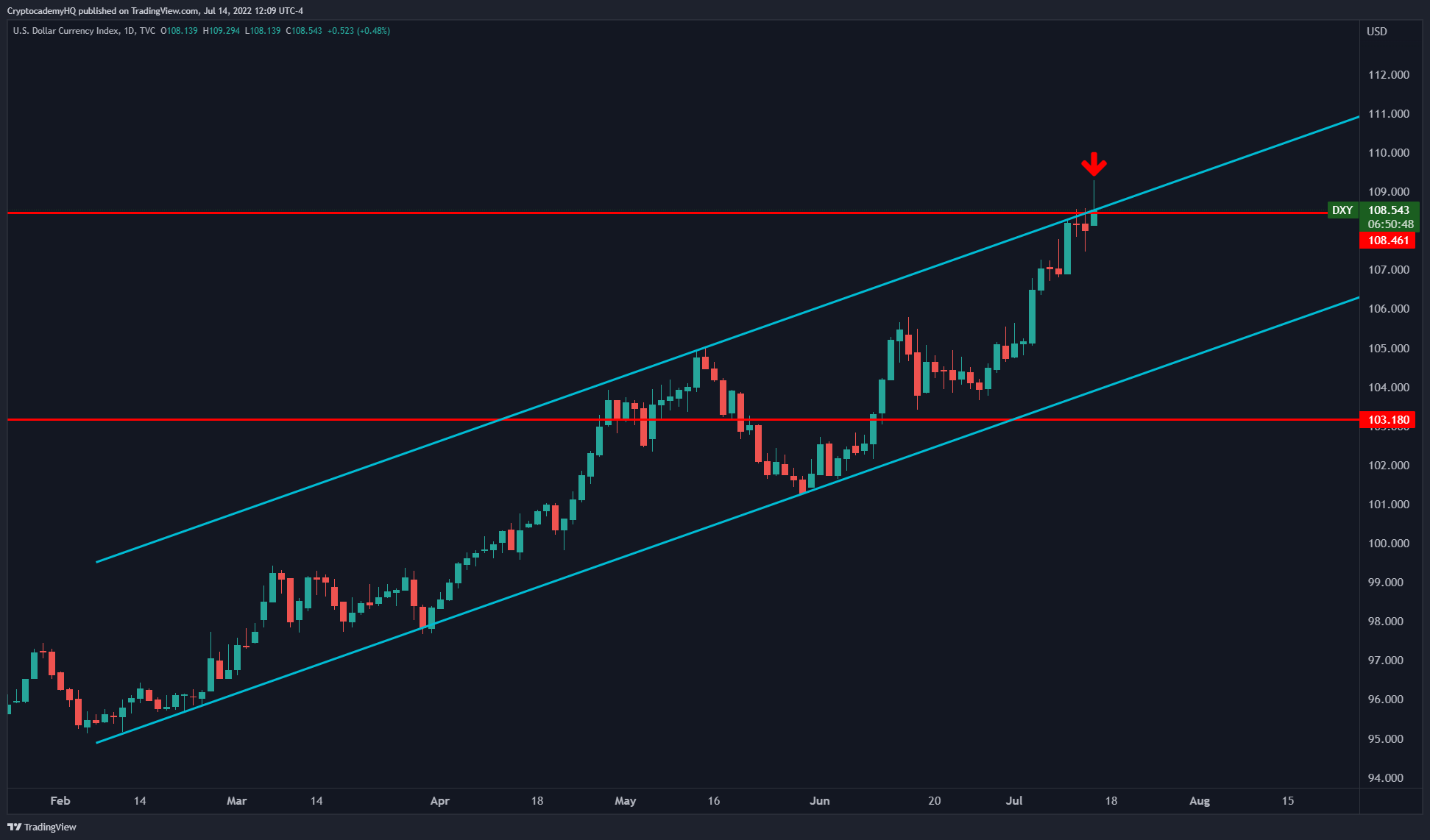

Diving deeper, Bennett says the US Dollar Index (DXY), a measure of the US dollar’s strength, is paramount to such a relief rally transpiring.

“The DXY is the key to a relief rally for crypto.

We need to see it back off 108.50, a confluence of resistance from 2001/02.”

A weak DXY can be seen as a bullish sign for digital assets, while a strong DXY could indicate bearishness.

Looking again at the above chart, the crypto trader warns the DXY needs to weaken today for a relief rally to occur.

“Not much DXY weakness so far from 108.50. Holding above it right now, in fact.

One to watch on Friday.

Need this to weaken to help fuel a further relief rally for crypto.”

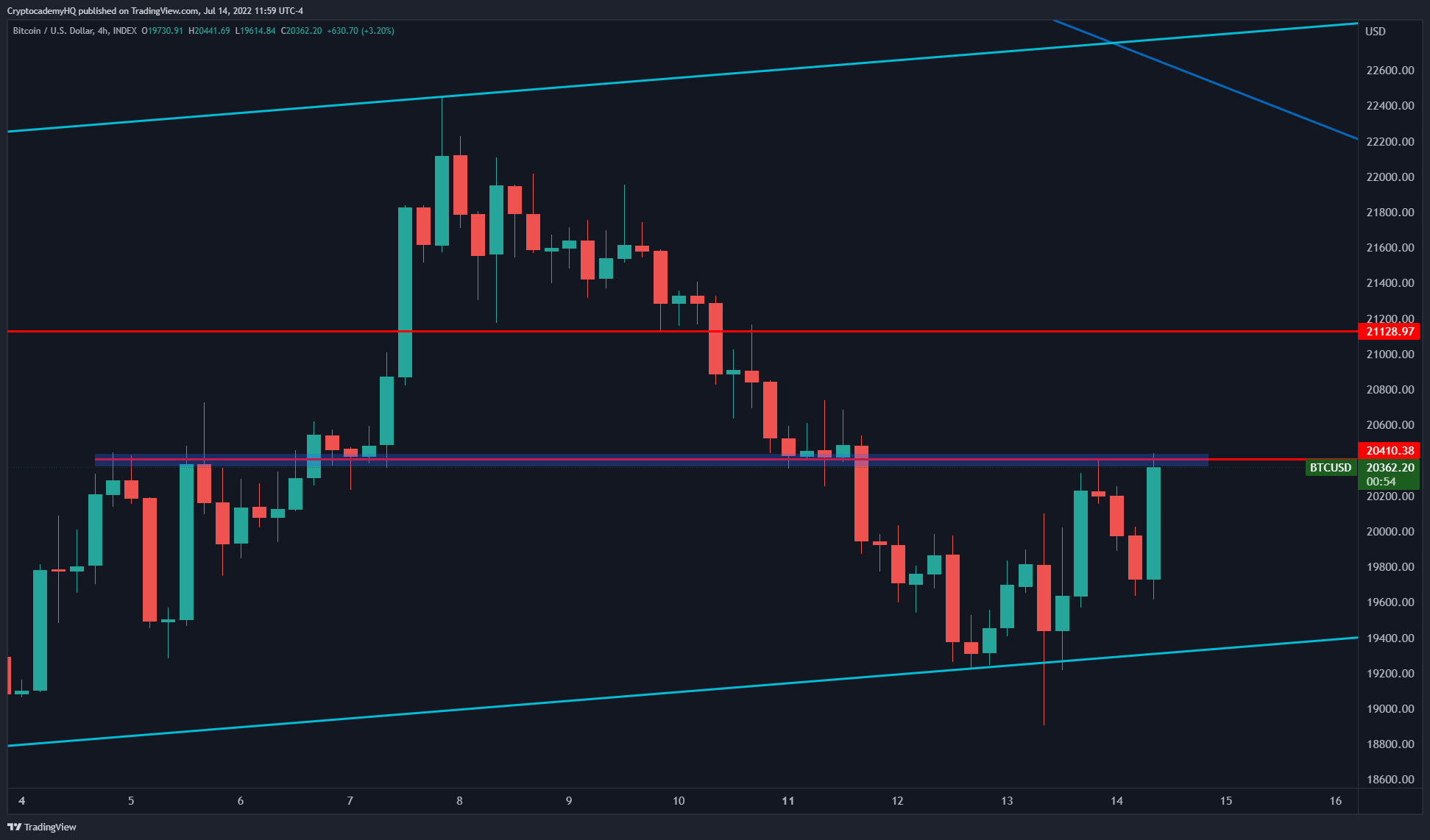

The analyst then looks at Bitcoin, trading for $20,522 at time of writing. Yesterday, Bennett said BTC staying above $20,400 was crucial for more bullish relief.

“Nice move from BTC after Wednesday’s bullish reclaim.

$20,400 is the next test for bulls.

Get above that and $21,100 is next.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/betibup33/David Sandron

Credit: Source link