In Todays Headline TV CryptoDaily News:

https://www.youtube.com/watch?v=68zYr02If3I

Binance looks to ramp up market share with free trading.

Crypto exchange Binance is ramping up efforts to grab market share by expanding its free trading to include popular token ether, ahead of one of the most anticipated events in the crypto market’s short history.

Cryptocurrencies Price Prediction: Shiba Inu

Shiba Inu price shows interesting on-chain metrics, which hint that the market bottom is not yet secure. Shiba Inu price currently auctions at $0.00001204 as the bears have rejected the notorious meme coin from the 8-day simple moving average.

Japan bringing in corporate crypto tax cuts to boost the economy.

Japan’s financial regulator, the Financial Services Agency, has decided to lower the taxes on crypto assets and individual stock investors in an attempt to boost the economy. Companies holding cryptocurrencies or responsible for creating and distributing them might be exempted from paying taxes for paper gains on coins.

BTC/USD saw a minor rise of 0.1% in the last session.

The Bitcoin-Dollar pair saw a minor rise of 0.1% in the last session. The Ultimate Oscillator is giving a positive signal. Support is at 19446.6667 and resistance at 20788.6667.

The Ultimate Oscillator is currently in positive territory.

ETH/USD skyrocketed 1.7% in the last session.

The Ethereum-Dollar pair skyrocketed 1.7% in the last session. The CCI is giving a positive signal. Support is at 1473.821 and resistance at 1657.661.

The CCI is giving a positive signal.

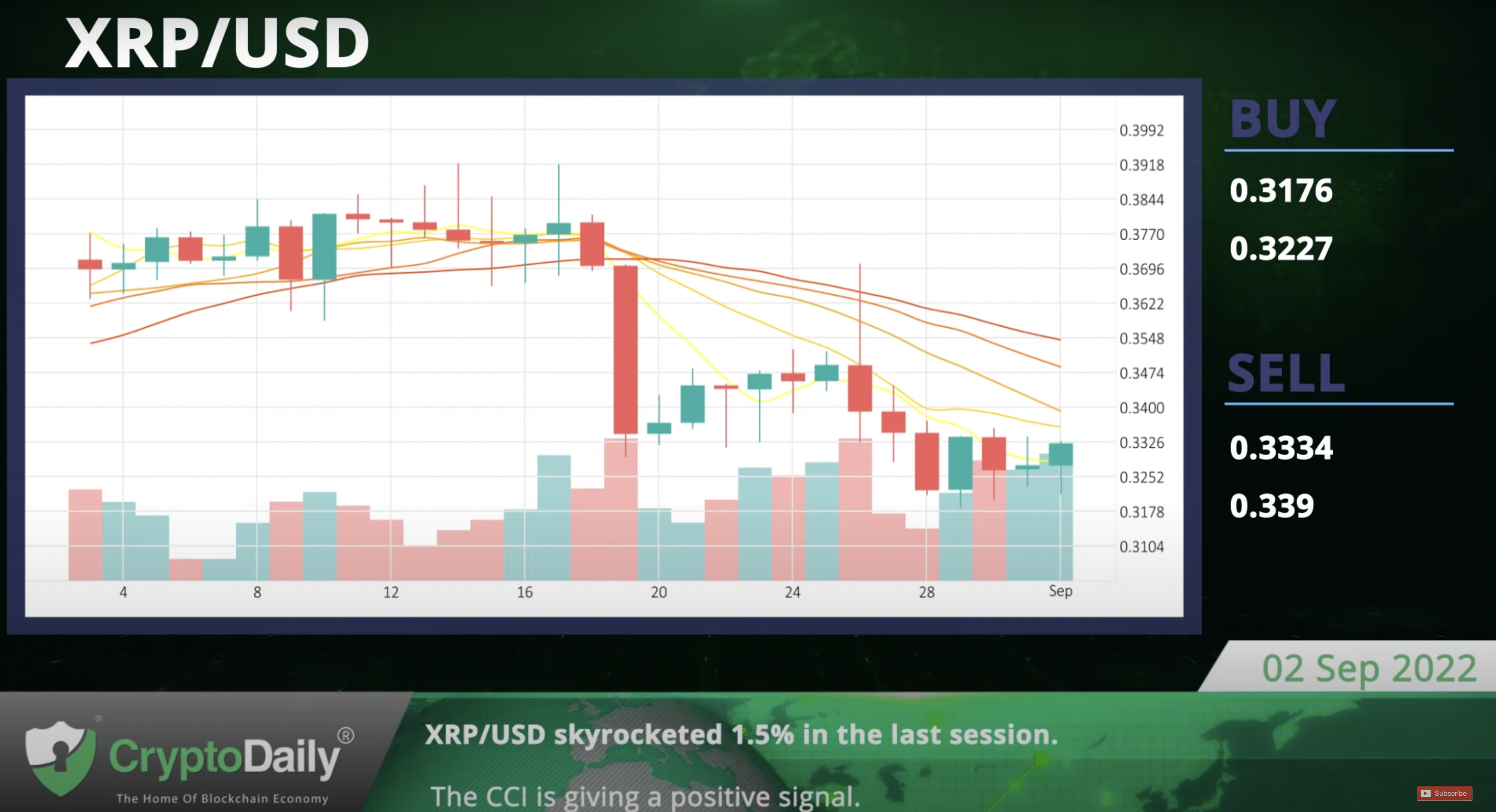

XRP/USD skyrocketed 1.5% in the last session.

The Ripple-Dollar pair exploded 1.5% in the last session. The CCI is giving a positive signal. Support is at 0.3176 and resistance is at 0.339.

The CCI is giving a positive signal.

LTC/USD exploded 6.6% in the last session.

The Litecoin-Dollar pair exploded 6.6% in the last session. The CCI is giving a positive signal. Support is at 51.8167 and resistance at 56.2367.

The CCI is currently in the positive zone.

Daily Economic Calendar:

US Nonfarm Payrolls

The Nonfarm Payrolls presents the number of new jobs created during the previous month, excluding the agricultural sector. The US Nonfarm Payrolls will be released at 12:30 GMT, the US Average Hourly Earnings at 12:30 GMT, and Germany’s Trade Balance at 06:00 GMT.

US Average Hourly Earnings

The Average Hourly Earnings are a significant indicator of labor cost inflation and of the tightness of labor markets.

DE Trade Balance

The Trade Balance is the total difference between exports and imports of goods and services. A positive value shows a trade surplus, while a negative value represents a trade deficit.

DE Exports

The Exports measure the local economy’s total exports of goods and services. Steady demand for exports helps to support growth in the trade surplus. Germany’s Exports will be released at 06:00 GMT, Japan’s CFTC JPY NC Net Positions at 19:30 GMT, and the UK’s CFTC GBP NC Net Positions at 19:30 GMT.

JP CFTC JPY NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

UK CFTC GBP NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Credit: Source link