The U.S. Internal Revenue Service (IRS) has modified the crypto question asked on the main U.S. tax form. Reducing the scope of the question, the IRS now focuses on taxable cryptocurrency transactions.

New Crypto Question on Tax Form 1040

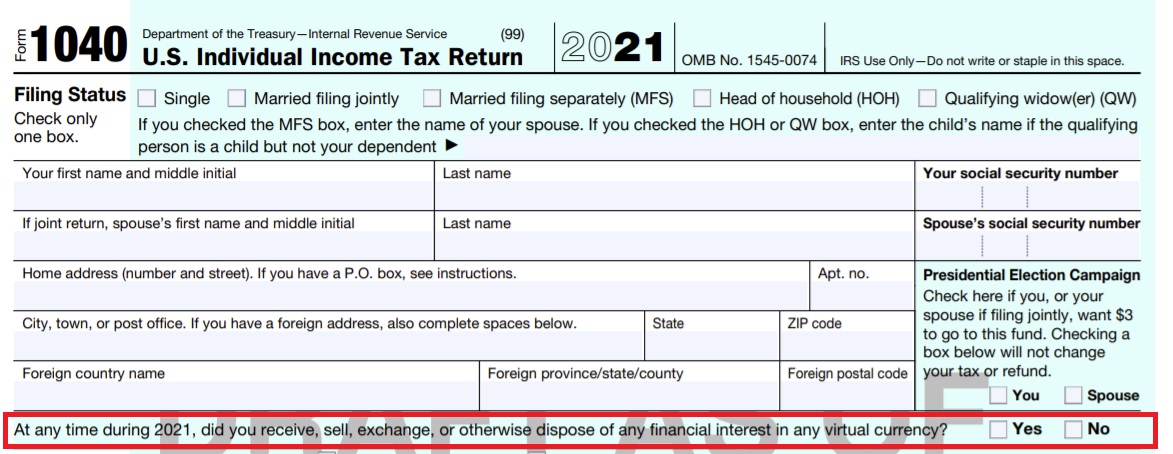

The IRS published a draft Form 1040 for the tax year 2021 Thursday. Form 1040 is the main tax form used for filing individual income tax returns in the U.S. The draft form shows that the tax agency has modified the crypto question slightly.

The crypto question now reads: “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

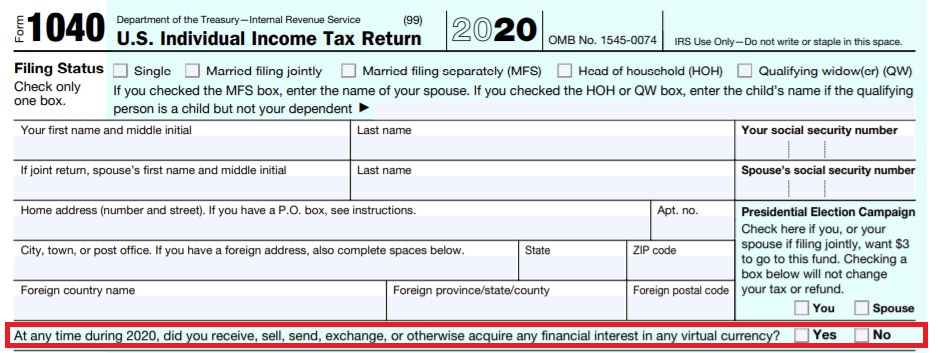

Previously, the question read: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

For the year 2021, the IRS has removed the word “send” and replaced “acquire” with “disposed of.”

Shehan Chandrasekera, Head of Tax Strategy at tax software company Cointracker, explained that “The revised question only inquires about your taxable transactions compared to the much broader scope of the 2020 version.”

He opined, “Although these changes have no big impact on your taxes, it hints at what the IRS has learned from the 2020 version and the direction it’s heading,” elaborating:

Under the revised question, you don’t have to check ‘Yes’ if you send cryptocurrency in between wallets/exchanges or acquire them, which are both non-taxable transactions.

What do you think about the new crypto question on the tax form? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link