The past few weeks have been hard on crypto bulls, as Bitcoin and the broader crypto market continued to sell off. Since reaching an all-time-high of $61,500, Bitcoin plunged 16% in a matter of a few weeks, shedding $100 billion in market capitalization. The major cryptocurrency saw signs of life as Elon Musk’s tweet sent prices back up to $56,000.

This would prove to not be enough, as Bitcoin continued to plummet, revisiting the $51,000 territory. Following a multi-day loss streak, bearish sentiment began to set in; investors and speculators began to brace for impact, fearing that the correction was far from over.

Today however, the market breathed a sigh of a relief as Bitcoin rose 6%, recovering back to $54,000. Tech index NASDAQ also pared its weekly losses, rising 1.4% into Friday market close — helping build Bitcoin’s intraday momentum.

Record Number of Bitcoin Options Expire: What’s in Store for April?

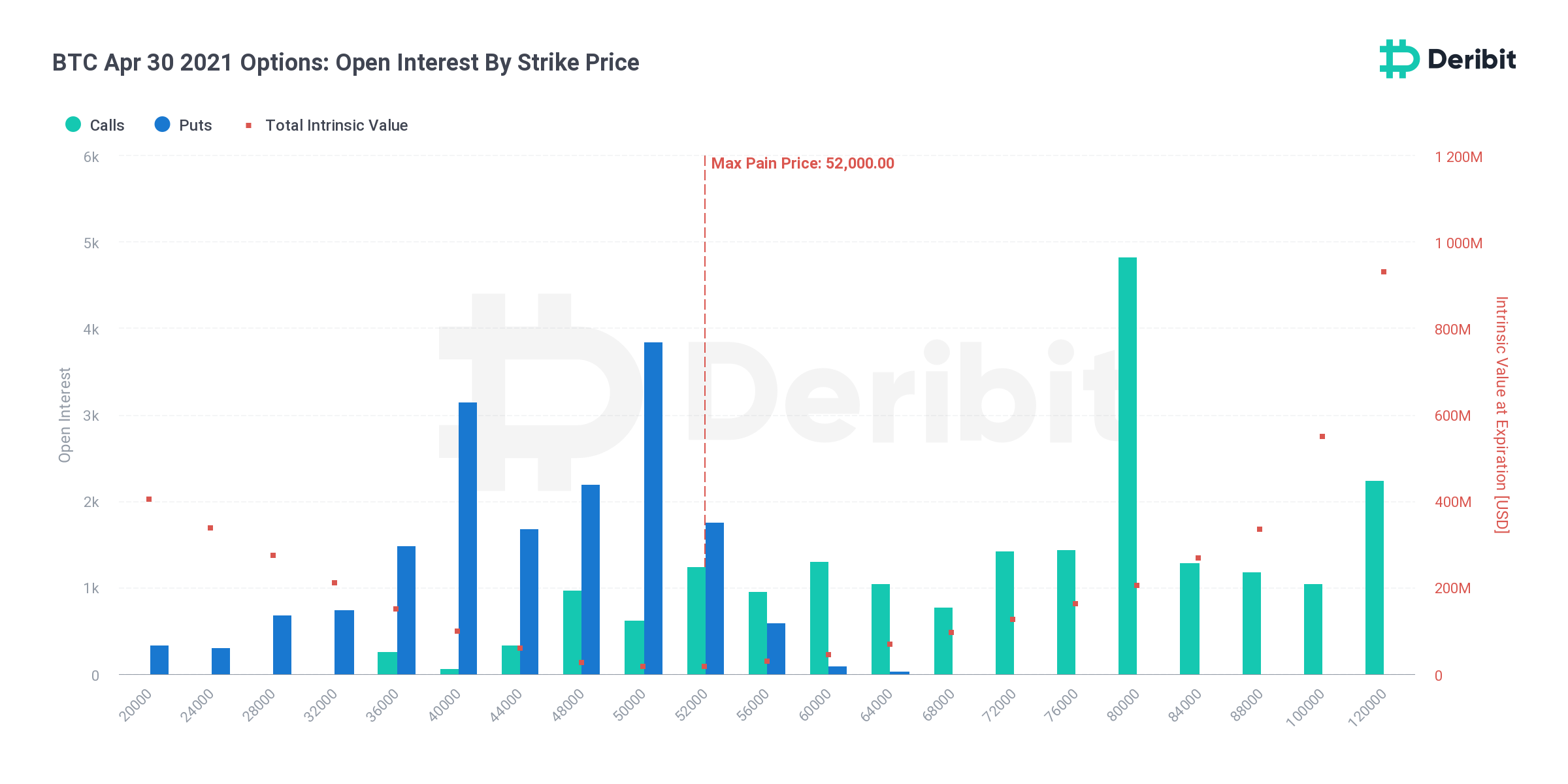

More importantly though, selling pressure likely slowed down thanks to a record $6.4 billion in options expiring earlier today. According to figures from DeriBit, the price expectation for Bitcoin remains higher for April compared to March. With April 30 contracts showing a put/call ratio of 0.80 as of press time, investors appear to be more bullish than before.

What’s interesting is that a majority of investors have placed their bets on Bitcoin to end April over $80,000. This particular strike price represents 12.6% of total open interest (4842 out of 38283), being the most popular call strike price. On the other side of the trade, the $50,000 put strike price accounted for 10.1% of total open interest.

From a glance, it’s clear that the options market has priced in a bullish sentiment for Bitcoin — for now. This is obviously subject to change, depending on various factors including catalysts, equities market, regulations, and more.

Institutional Inflow Continues to Slow: Worrying Sign?

With Bitcoin’s recent price action and extreme volatility, many institutions previously interested were likely thrown off. According to a report from CoinShares, institutional demand for Bitcoin investment products dropped in the latter weeks of March. They saw institutional inflow drop nearly 60% in a single week.

Despite this, it’s likely that institutional demand will ramp back up as Bitcoin stabilizes. One of New Zealand’s retirement funds recently disclosed that Bitcoin accounted for 5% of its investment holdings. Temasek, Singapore’s $306 billion sovereign wealth-fund, also revealed that it had been amassing the digital currency since 2018.

Major investment bank Goldman Sachs has also remained bullish on the cryptocurrency, filing to create their own financial products tracking Bitcoin. In conclusion, the recent drop in institutional inflow is not a worrying sign in the long haul. More likely than not, institutional demand will ramp back up as Bitcoin’s price stabilizes.

Credit: Source link