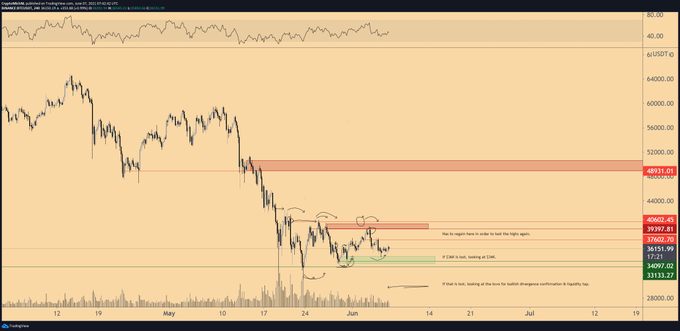

Bitcoin has been trying to breach the psychological price of $40k after the top cryptocurrency nosedived to lows of $30k on May 19 from an all-time high of $64.8k recorded in mid-April.

Market analyst Michael van de Poppe believes that a breakout might happen in the week because the volume is draining down. He explained:

“Bitcoin is ready for the climax. Lower highs, higher lows, volume draining down. All levels are tested, even $34,800 is now tested. The breakout of this construction should be happening in the next 7 days or so.”

BTC suffered a sharp correction on May 19 as the price fell to around $30,000, resulting in the biggest single-day drop of price, up to 30%. Furthermore, this price drop became the first time BTC had dropped below the 200-day moving average (MA).

The 200-day MA is a key technical indicator used to determine the general market trend. It is a line that shows the average closing price for the last 200 days or roughly 40 weeks of trading.

Bitcoin miners sold more than 5,000 BTC in the past week

According to on-chain analyst William Clemente III, Bitcoin miners liquidated their holdings by selling more than 5,000 BTC last week.

On the other hand, the number of active Bitcoin addresses hit a 7-month low of 49,648.964, as acknowledged by on-chain metrics provider Glassnode.

Notable BTC adoption, however, was experienced in Southeast Asia, according to Joseph Young. The crypto analyst explained:

“There is massive Bitcoin and overall crypto adoption happening in Southeast Asia. Particularly, the Philippines, Thailand, and Vietnam are showing a rapid increase in user activity. Price talk aside, this fundamental growth is very inspiring and optimistic.”

Meanwhile, El Salvador seeks to be the first nation to legalise Bitcoin as legal tender. If this materialises, BTC is expected to boost the nation’s economy by offering financial inclusion and generating jobs.

Image source: Shutterstock

Credit: Source link