A popular crypto analyst thinks Bitcoin (BTC) could be following a pattern that happened at the end of previous bear markets.

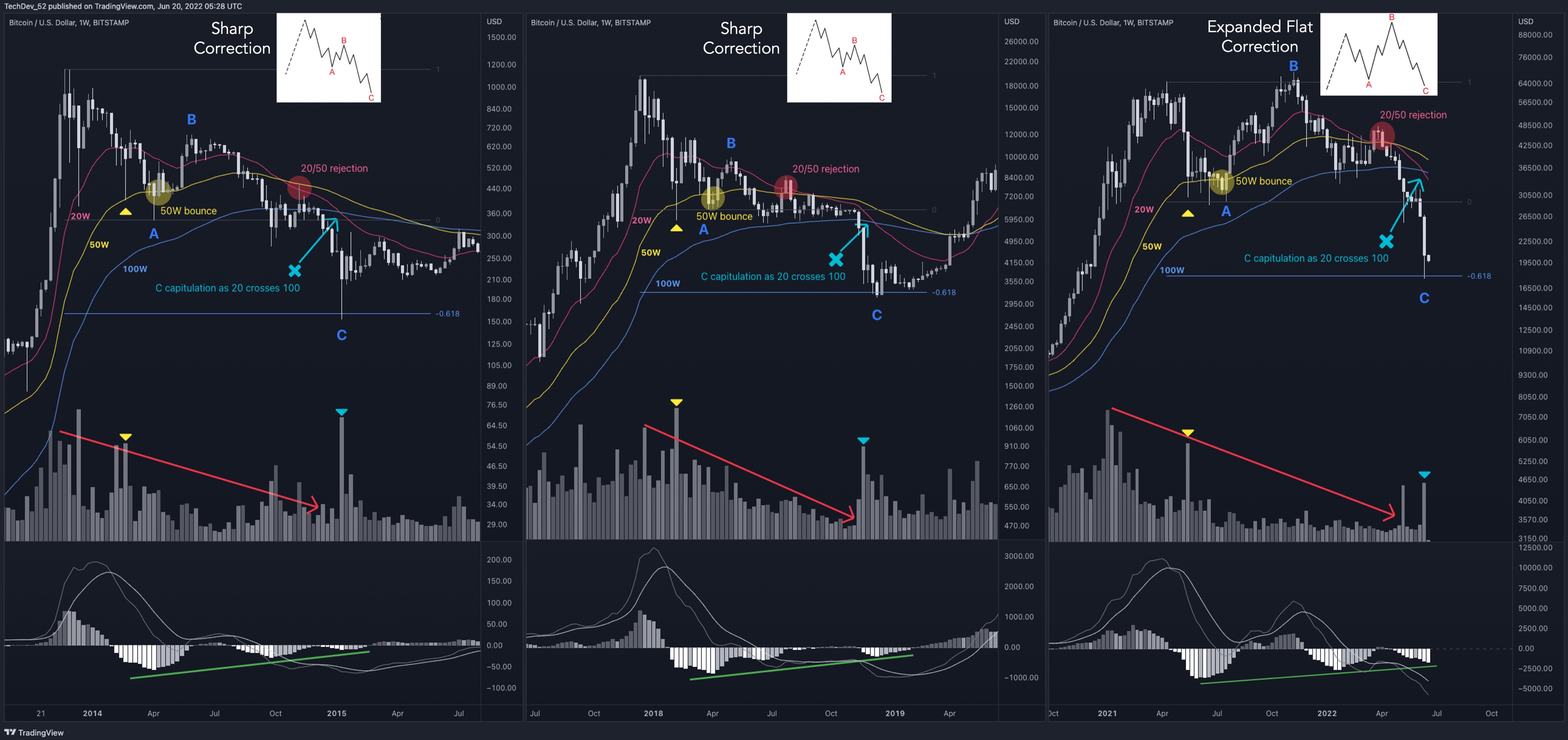

Pseudonymous analyst TechDev tells his 397,700 Twitter followers that BTC’s price action over the past year appears to be closely mirroring Bitcoin’s sharp corrective moves during the 2014 and 2018 bear cycles.

TechDev highlights that in the previous corrective phases of Bitcoin, BTC followed the exact same script where it initially bounced at the 50-week exponential moving average (EMA) before finding resistance at the 20-week EMA. The crypto strategist also says the final leg of the previous two bear markets happened after the 20-week EMA crossed below the 50-week EMA.

“- A to the 50W EMA

– B above the 20W [EMA]

– Final leg of C after 20 crosses 50

– Terminates after 20 crosses 100?

Curious if this year+ BTC correction continues to follow the blueprint of the last two.”

So far, the analyst says Bitcoin has been following the blueprint of its previous bear markets and that a close above the 20-week EMA would likely confirm the end of the correction.

“Year+ BTC corrections:

Volume decline [yes]

MACD bull div [yes]

A capitulation + 50W EMA bounce [yes]

B above 20W, C breaks 50W with ease [yes]

C consolidates at 100W + 20/50W rejection [yes]

C capitulation as 20/100W cross [yes]

C bottom near -0.618 of A [yes]

Close above 20W likely confirms end.”

Bitcoin is trading for $20,603 at time of writing, down more than 70% down from its all-time high. Meanwhile, the 20-week EMA is hovering above $33,000.

TechDev says his paper portfolio is “down significantly” but that he hasn’t changed his long-term investment thesis.

“I believe Bitcoin and the crypto market will make new highs before the next halving.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/Tithi Luadthong

Credit: Source link