These are some of the factors that have made Ethereum record an annual return of 663.7% compared to Bitcoin’s 195.5% so far, according to CoinGecko.

Various use cases in the Ethereum (ETH) ecosystem have made it one of the sought after networks in the crypto space. For instance, it has played an instrumental role in the growth of the booming decentralized finance (DeFi) and non-fungible tokens (NFTs) sectors based on some of the features it offers, like smart contracts.

A year ago, Ethereum’s price stood at $616 compared to the current $4,565, whereas Bitcoin’s was $19,435 in contrast to the present $56,792.

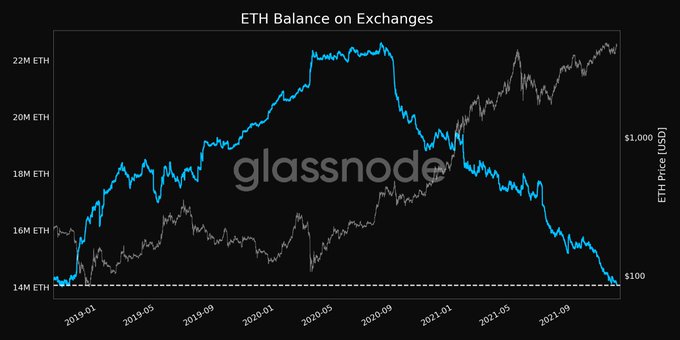

Ethereum has also been exiting crypto exchanges in droves, and this has been aiding its price rally. This signifies a holding culture because coins are transferred to cold storage and digital wallets for future purposes, making liquidation a bit difficult.

For instance, Ethereum balance on exchanges recently reached a 3-year low of 14,063,528.118 ETH, according to market insight provider Glassnode.

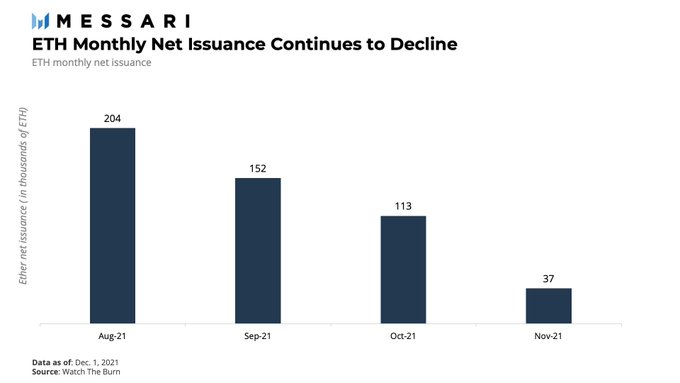

Ethereum’s net issuance dropped to $37,000 ETH in November

According to Mason Nystrom, a researcher at Messari:

“Ethereum net issuance continues to decline with only ~37K ETH issued in November. At this rate, if market demand continues, Ethereum may see its issuance become deflationary relatively soon.”

ETH’s net issuance has been down-trending ever since the London Hard Fork or EIP 1559 upgrade went live on August 5. For example, this metric stood at 204,000 ETH in August compared to November’s 37,000 ETH.

This is because the London Hard Fork is continuously making Ethereum scarce, given that Ether is burnt every time it is used in transactions. This upgrade has also saved ETH users a total of $844 million in transaction fees through base fee refunds.

Image source: Shutterstock

Credit: Source link