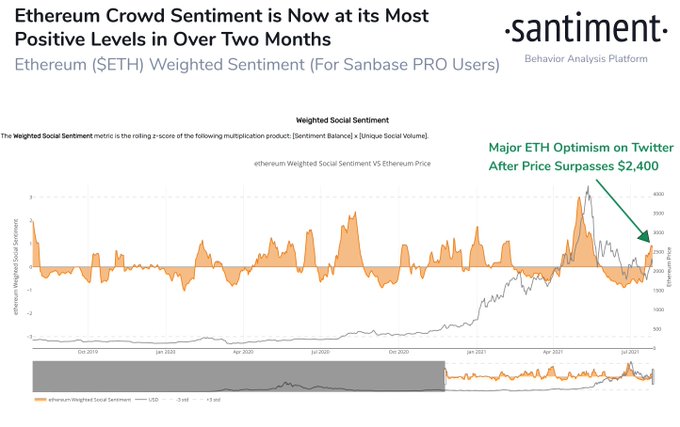

Ethereum recently jumped above the $2,400 level, triggering crowd sentiment on Twitter to hit a two-month high, as acknowledged by Santiment.

The on-chain metrics provider explained:

“Ethereum is showing its most positive sentiment right now since mid-May.”

The crypto market experienced a significant upward momentum after Amazon Inc hinted that it would allow its users to pay for products using cryptocurrencies before the company denied it.

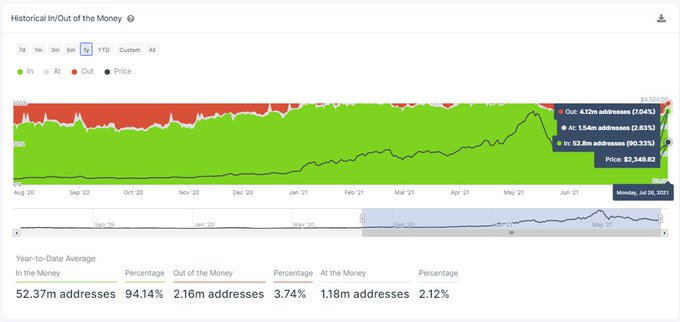

This price surge made nearly 2 million ETH addresses return to profitability. Data analytic firm IntoTheBlock stated:

“As ETH surpassed the $2,300 mark again, the Historical In/Out of the Money indicates that roughly 2 million addresses are back ‘in the Money’ since yesterday. At the current price, 94.14% of the addresses (52.36m) currently holding ETH are in a state of profit.”

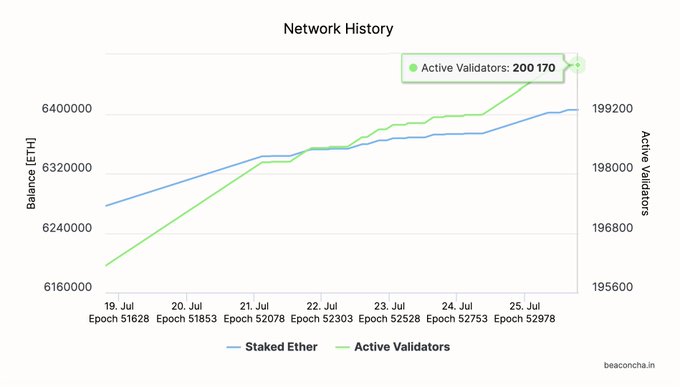

Ethereum 2.0 validators top 200,000

According to crypto insight provider Bloqport, ETH 2.0 surpassed 200,000 validators as more investments continue trickling into this deposit contract.

As a result, 5.5% of Ethereum supply is locked in ETH 2.0.

Ethereum 2.0, also known as the Beacon Chain, was launched in December 2020 and was regarded as a game-changer that seeks to transit the current proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) framework.

The ETH 2.0 upgrade is expected to slash daily emissions in the Ethereum network by 90%, from 12,800 to 1,280. Moreover, yearly inflation is likely to drop from 4.3% to 0.43%.

Based on this upgrade, Ethereum is also anticipated to undergo Triple Halving, which is a highly significant economic event for the asset’s price in the coming years.

Meanwhile, ETH has been leaving exchanges in droves. This is bullish based on market forces that price increases whenever supply drops and demand rises.

With a supply squeeze expected in the Ethereum market, whether this will trigger a price surge remains to be seen.

Image source: Shutterstock

Credit: Source link