Crypto analytics firm Santiment is digging into the charts to see what caused Bitcoin (BTC) to surge dramatically in recent days.

The market insights agency says that the lessening concerns about macroeconomic data and geopolitical events are helping Bitcoin investors achieve gains of more than 10% when calculating market value to realized value (MVRV).

“Bitcoin has now returned all the way back to $46,800 for the first time since January 4th.

The 11-week high comes as inflation, war, and Covid-19 fears have all eased significantly, giving BTC traders an average mid-term trading return of over 10%.”

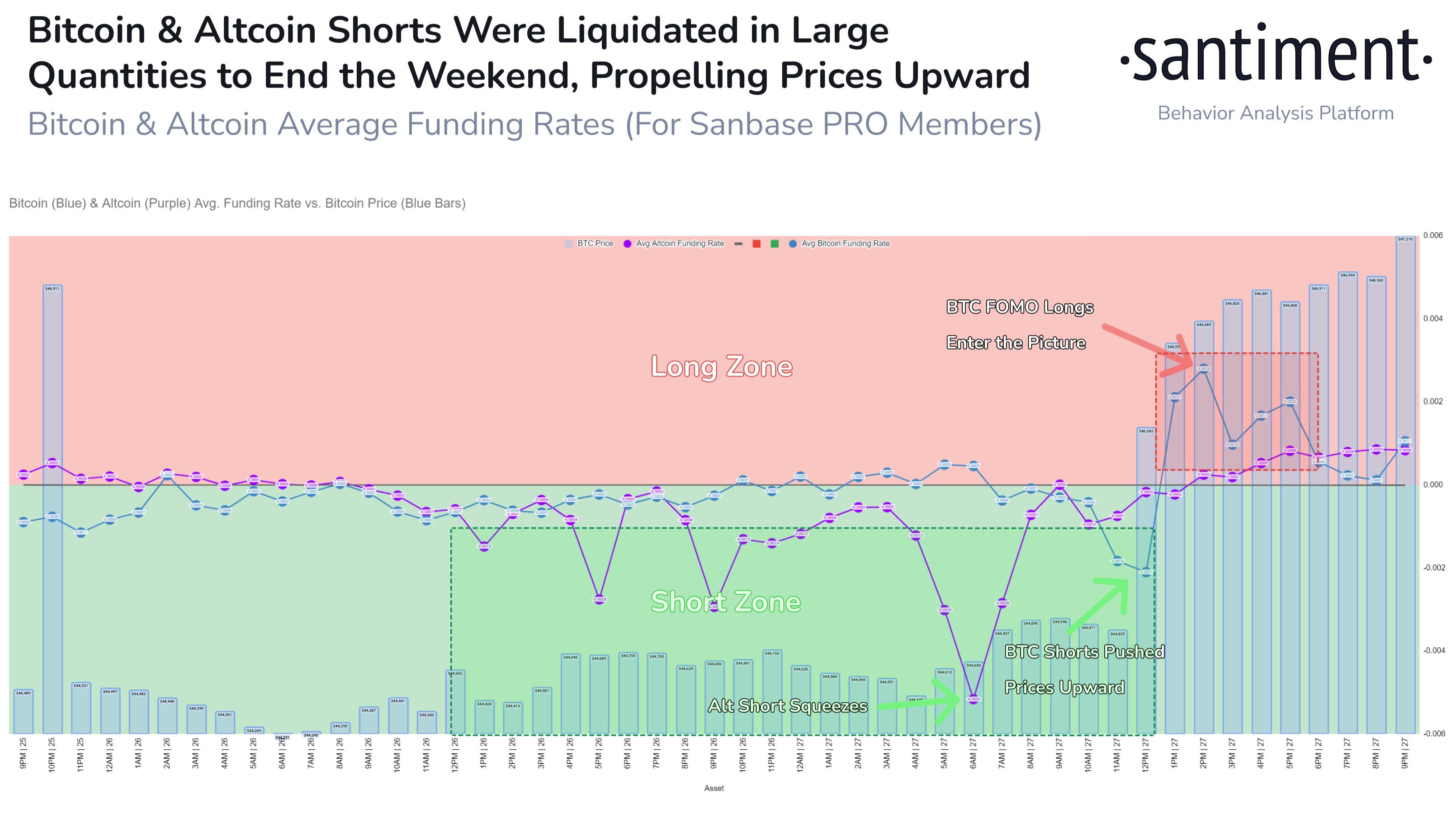

The data firm provides a three-day chart of Bitcoin while discussing how short liquidations accounted for much of BTC’s jump to the upside.

“Bitcoin launched to $47,200, its highest price since January 3rd. The massive amount of shorts that were growing on exchanges is the primary culprit for this jump.

Altcoins really saw a huge short ratio at 1pm UTC, followed by BTC at 6pm UTC, spiking all of crypto.”

Short liquidations happen when traders who are betting on Bitcoin’s price to go down are forced to buy BTC as the market moves against their bias.

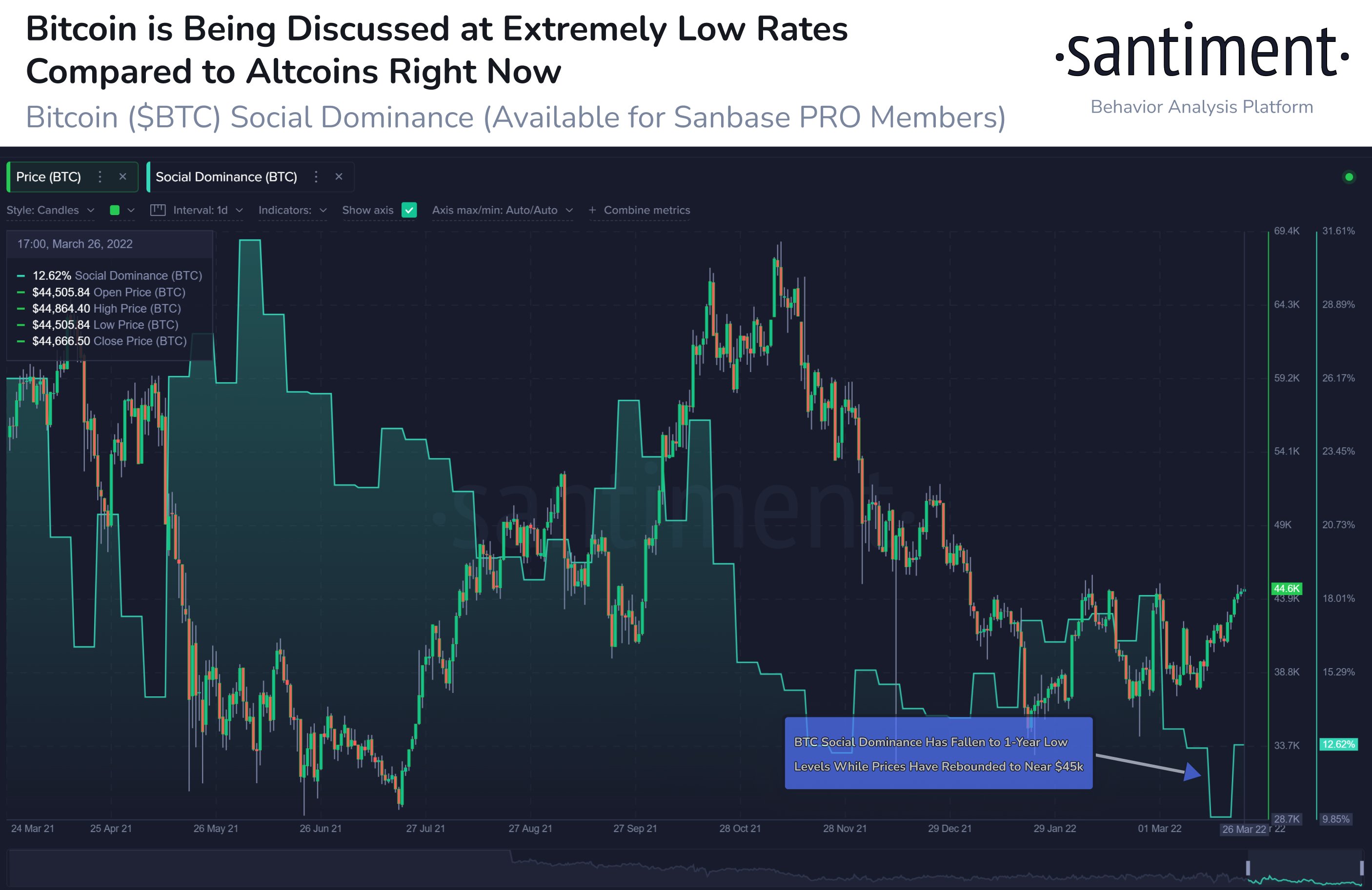

Santiment is also looking at Bitcoin’s social dominance on the one-year timeline, where BTC has fallen to a yearly low. Although the firm expects renewed interest in the leading crypto asset by market cap, what remains to be seen is whether Bitcoin continues to rise or retraces after seeing a 25% price increase in recent weeks.

“The rate of discussion toward Bitcoin compared to other altcoins is at one-year low levels, as Cardano and other top assets have been getting more of the spotlight.

Look for crowd focus on BTC to return as either a bull run or capitulation occurs.”

At time of writing, Bitcoin is up nearly 2% and is valued at $47,221.

Despite crashing to below $33,000 back on January 24th, BTC has now almost completely returned to its New Year’s Day starting price of $47,292.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/fran_kie

Credit: Source link