New data shows institutional investors are jumping on the opportunity to buy Bitcoin and one of Ethereum’s main competitors.

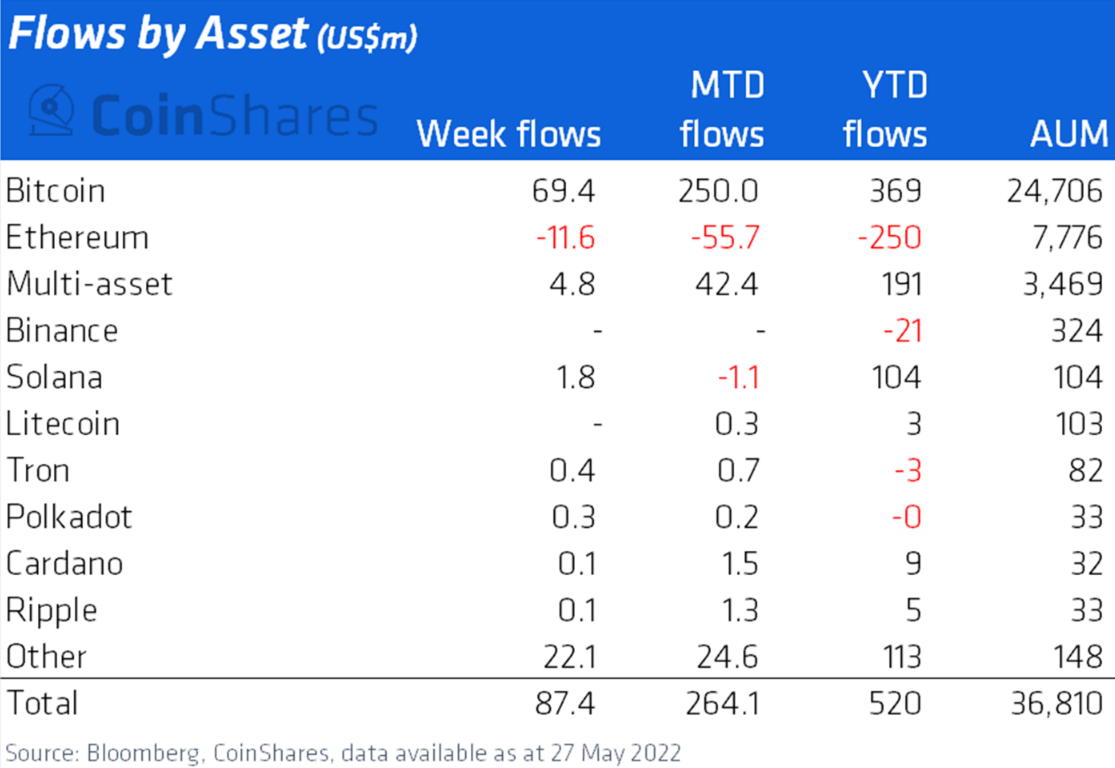

In its latest Digital Asset Fund Flows Weekly report, CoinShares finds digital asset investment products enjoyed inflows nearing $90 million last week, with leading crypto asset Bitcoin taking the lion’s share.

“Digital asset investment products saw inflows totaling $87 million last week, pushing year-to-date inflows just past the half a billion mark to $0.52 billion.

Bitcoin saw inflows totaling $69 million, bringing year-to-date inflows to $369 million…”

CoinShares notes that Bitcoin’s assets under management (AuM) are also at their lowest point since July of last year.

For the first time in over one month, both the North American and European regions saw digital asset institutional investment product inflows, at $72 million and $15.5 million, respectively.

Ethereum products continued their recent trend of outflows, losing $11.6 million last week.

“Ethereum resumed its grind lower with outflows totaling $11.6 million last week, bringing net outflows year-to-date to $250 million, a stark contrast to most other altcoins.”

Ethereum competitor Algorand (ALGO) exploded last week. The decentralized finance (DeFi) blockchain had a record week of institutional investment inflows at $20 million, according to the report.

Other blockchains such as Tron (TRX), Polkadot (DOT), Cardano (ADA), Solana (SOL) and XRP, saw weekly inflows of $1.8 million, $0.4 million, $0.3 million, $0.1 million, and $0.1 million, respectively.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Marciano Graphic/Fotomay

Credit: Source link