A seasoned crypto analyst is closely tracking Bitcoin (BTC) price action as he attempts to determine whether the leading crypto by market cap has carved a bottom.

John Bollinger, the technical analyst who invented the Bollinger Bands metric, tells his 222,100 Twitter followers that after BTC’s drop from its all-time high of $69,000 to below $20,000, Bitcoin may actually be in a position put in a macro bottom.

“Picture perfect double (M-type) top in BTC/USD on the monthly chart complete with confirmation by BandWidth and %b leads to a tag of the lower Bollinger Band. No sign of one yet, but this would be a logical place to put in a bottom.”

While traders use Bollinger bands to predict an asset’s next volatile move, the bands themselves could also indicate potential reversal areas. Traders view the upper band as resistance while they see the lower band as support.

In the case of Bitcoin, Bollinger highlights that BTC has managed to stay above the lower band on the monthly chart, suggesting Bitcoin could carve a bottom at current prices.

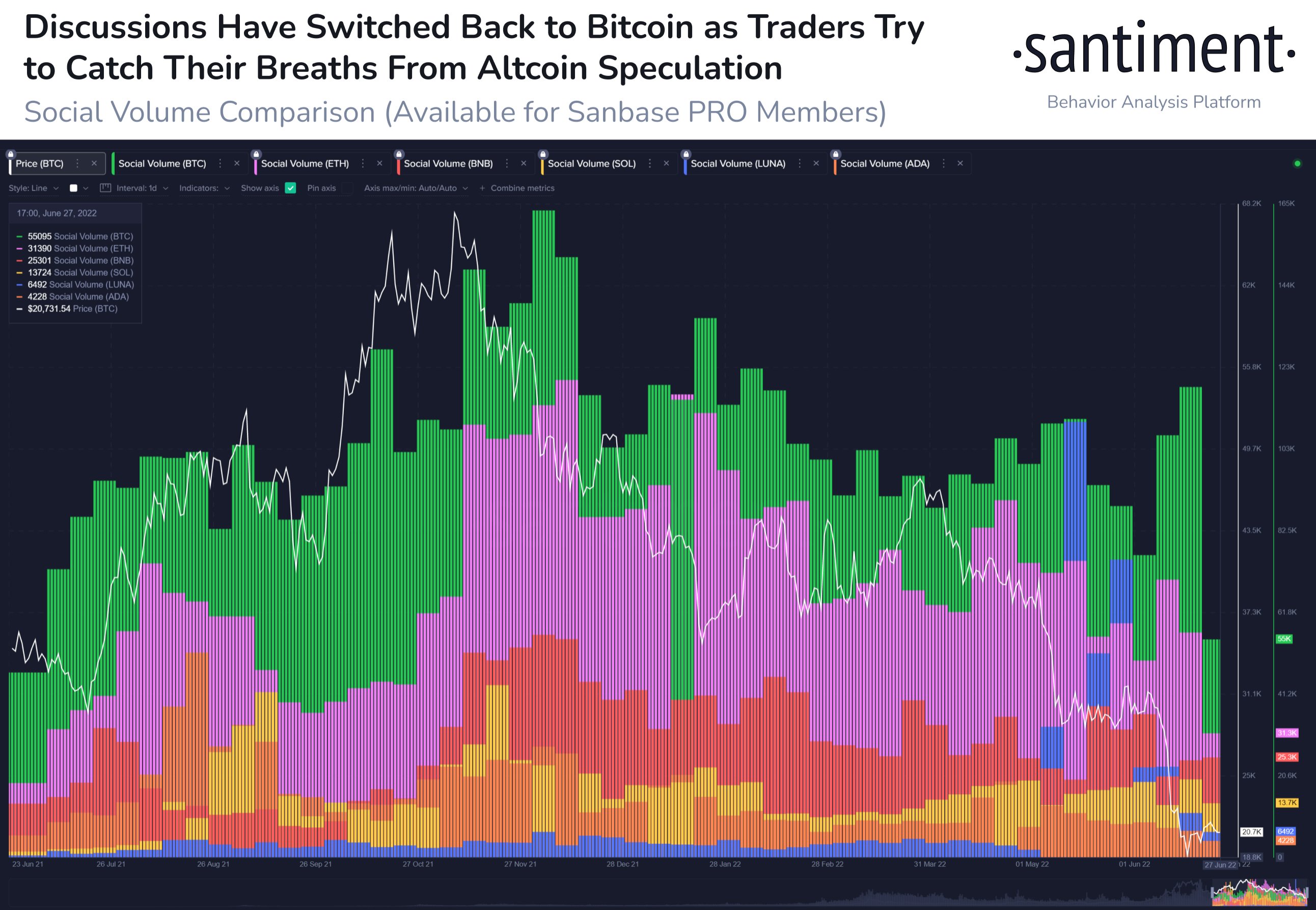

Bollinger’s analysis comes as leading analytics firm Santiment says they’re seeing positive on-chain signals for BTC. According to Santiment, interest in Bitcoin has risen this month, indicating that traders are taking a break from heavy altcoin speculation.

“Bitcoin is seeing increased discussion in the latter half of June after the majority of altcoins have dropped 80% or more from their November market cap values. Historically, declining interests in inorganic alt pumps are a positive sign for crypto.”

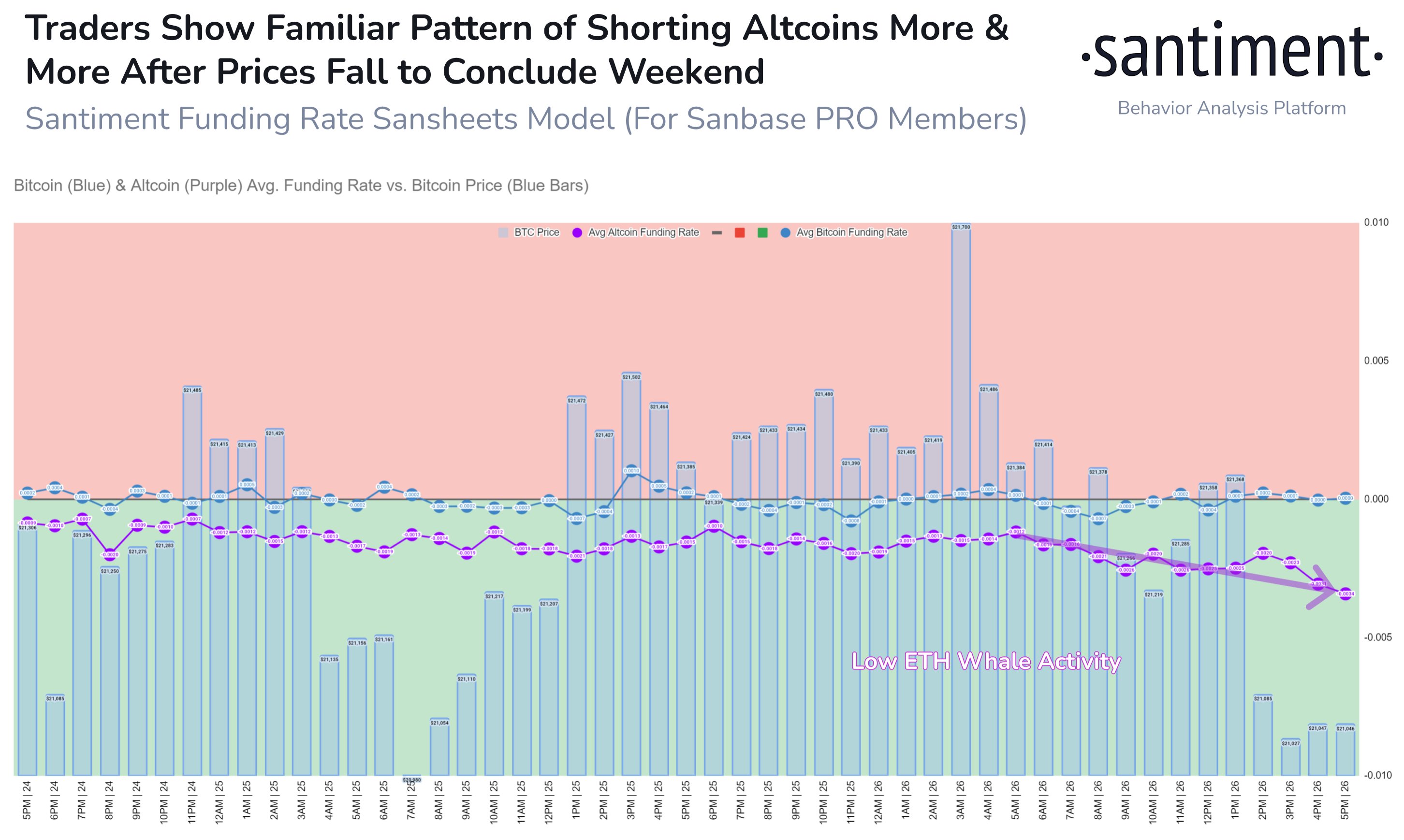

Santiment also says that as the crypto markets pulled back over the weekend, traders prioritized shorting altcoins.

“As prices gradually fell on Sunday, traders have shown that though they may proclaim to be buying the dip, they are shorting more on these mini drops. Interestingly, this only applies to altcoins right now, indicating that Bitcoin is being flocked to as the safe haven.”

At time of writing, Bitcoin is trading for $20,300, down 2.6% on the day.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/wacomka

Credit: Source link