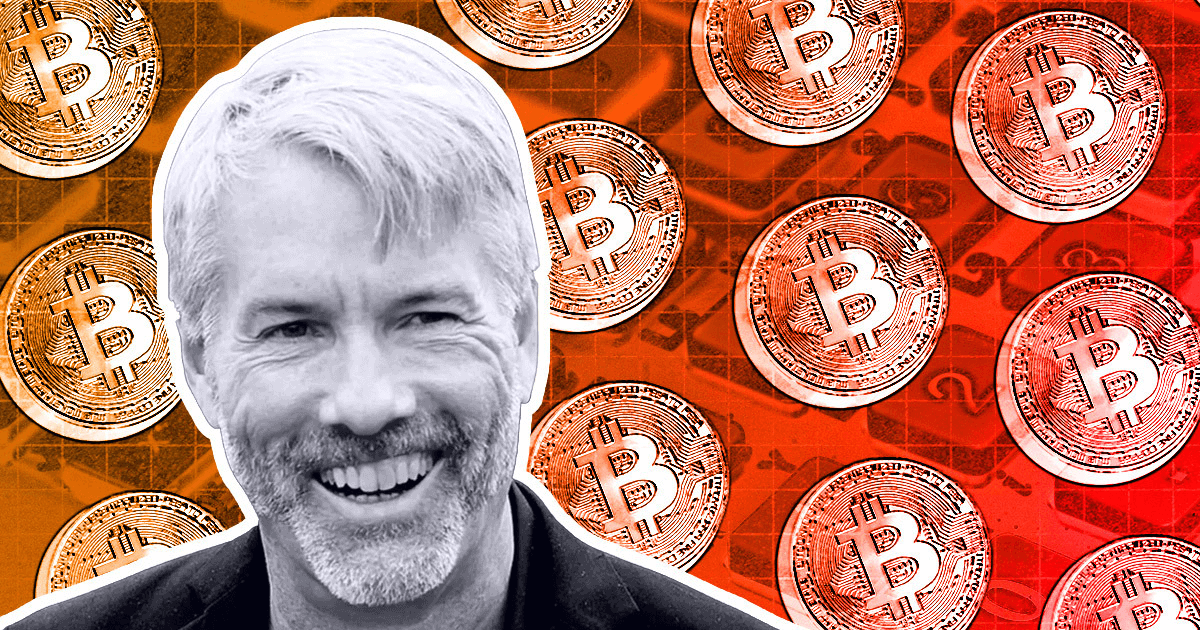

The Chief Executive Officer of MicroStrategy and Bitcoin maximalist Michael Saylor has expressed excitement about the U.S. Financial Accounting Standards Board (FASB) decision to review rules for crypto.

Congratulations to the #Bitcoin community. This morning, by unanimous vote of 7-0, the Financial Accounting Standards Board (FASB) agreed to add a project to review Accounting for Exchange-Traded Digital Assets and Commodities.

— Michael Saylor⚡️ (@saylor) May 11, 2022

FASB to review crypto accounting framework

The current FASB guidelines provide that companies should report digital assets and commodities as “intangible assets” on their balance sheets. This is because cryptocurrencies don’t meet the standard definition of “cash and cash equivalents, financial instruments, financial assets, and inventory.”

The rule means that companies like MicroStrategy, which has most of its assets in Bitcoin, can’t report crypto as a tangible asset on its balance sheet. Companies holding intangible assets must measure them using the lowest price within the reporting period.

This reporting standard usually results in impairment losses for companies holding crypto even if the firm maintains its position. MicroStrategy recorded over $800 million in impairment losses due to the rule. In the first quarter alone, the firm reported an impairment loss of over $170 million.

Given that the FASB is yet to announce the decision officially, the review date is unclear. There’s also no assurance of the outcome.

But adopting a different set of rules that applies explicitly to cryptocurrency instead of traditional finance standards will make it easier for companies holding crypto to report more accurately.

Crypto crash leads to impairment losses for institutional holders

The performance of the crypto market in the past couple of months means that most Bitcoin holding companies have reported impairment losses on their assets.

However, these companies, including Tesla, have not made any losses through sales and are usually still at a profit.

A good example is Townsquare Media. The New York-based company reported an impairment loss of $400,000 on its BTC in the first quarter; however, it sold its position for a $1.2 million profit on March 31.

For MicroStrategy, Bitcoin’s rapid drop in value to $28,000 means the company now has actual impairment losses. In its Q1 report, it stated that the average purchase price of its BTC holding is $30,700.

Credit: Source link