Many people are skeptical about cryptocurrencies due to the sector’s volatility. But more people in emerging markets are embracing it as a way to make more returns in the long run. No one can argue that investing in cryptocurrencies is very risky, but there’s also no doubt that it offers long-term promises for high ROI.

So, it’s not surprising that a recent survey exposed that LATAM and APAC investors believe in the long-term growth potentials of cryptocurrencies. In the study carried out in these markets, 75% of investors were eager to increase their investments. These investors are mainly in Latin America and Asia-Pacific markets.

The Toluna researchers’ research involving 9000 investors from 17 countries revealed that those from APAC & LATAM opined that making a crypto investment is profitable in the long run, given the upwards trend that seems to continue.

Related Reading | Binance’s Bitcoin Dominance Sharply Rises, Now Holds 22.6% Of Total Exchange Supply

This opinion is different from what participants in the developed markets believe. According to them, cryptocurrencies will soon notice another upcoming hype circle, not in the long run.

Emerging Cryptocurrencies Hold Immense Potential

Presently, the most lucrative market for crypto is the emerging market. This is because at least 32% of the consumers there still believe that crypto investment is worth it in the long run.

Unlike the developed markets where trust for crypto investment was found only amongst 14% of the consumers. Countries such as European Union and the USA are not too supportive or believe that crypto is the way forward.

But when it comes to the reason for these differences in response, the researchers discovered that many people are yet to understand crypto in its total capacity.

Furthermore, they found that even amongst the 61% of respondents that claimed to know cryptocurrencies, only 23% see the asset class. That’s why the research firm concluded that this is due to the complexities of the crypto concept.

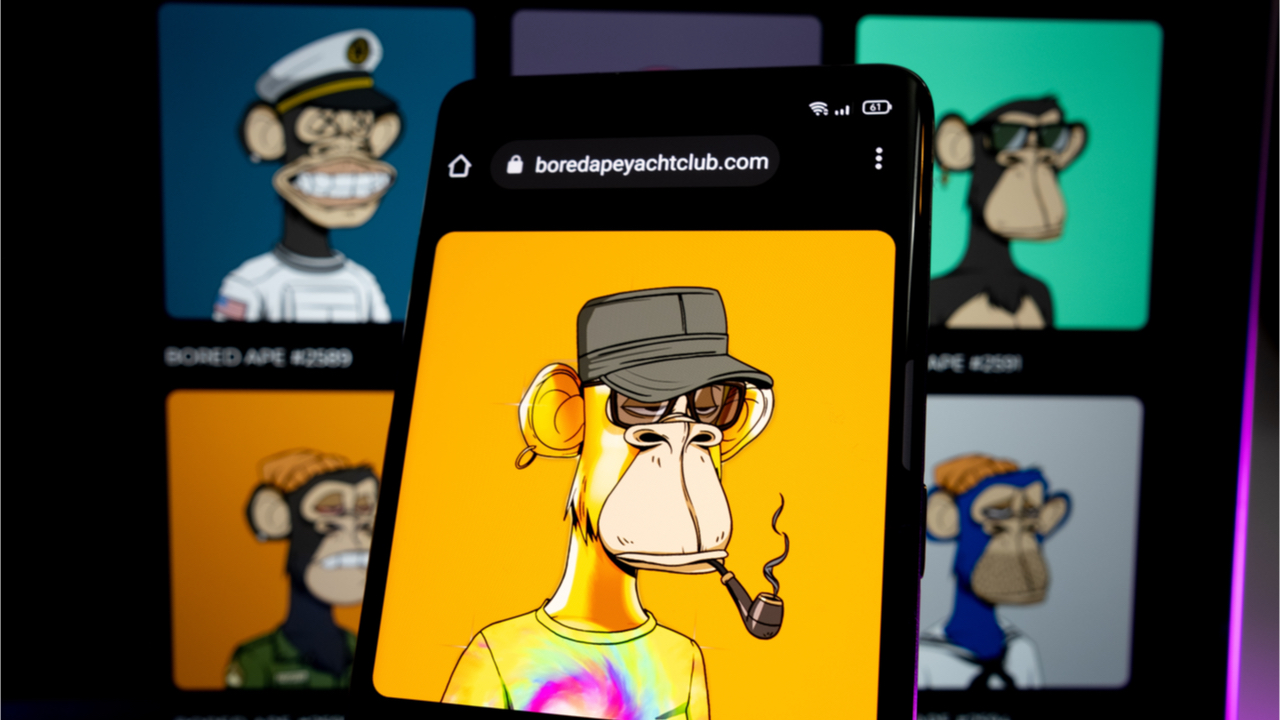

For instance, many ads promote NFTs to increase awareness of the sector. But none is targeted to help people understand what NFTs are all about.

Related Reading | El Salvador’s Bitcoin Journey Kicks Off With A Bummer, BTC Price Crashes

The research also showed that 41% of emerging markets have invested in crypto while the developed markets have but 22%. Also, 42% of players in the developed markets opine that crypto is risky, while only 25% in emerging markets believe such.

Millennial Investors Ahead In Cryptocurrency Adoption

Toluna revealed that Millennial is taking the lead among the people who have invested in crypto. According to the data, 40.5% between the ages of 25 to 34 in both markets are crypto investors. Besides Toluna, another company, Morning consults, also discovered that 48% of millennial homes are crypto owners.

This is different from those between the ages of 57 to 64, also known as Baby Boomers. However, this group only represents 21% of crypto investors.

Featured image from Pexels, chart from TradingView.com

Credit: Source link