A popular crypto analyst and trader is warning his followers that Ethereum (ETH) could suffer a nearly 45% drop if current support breaks.

Cryptocademy founder Justin Bennett tells his 108,500 Twitter followers that ETH is testing the “neckline” on a possible head and shoulders trend.

“ETH is testing the neckline.

The target is $800 if this breaks.”

With ETH currently trading for $1,142, a drop to $800 would represent a 44% decline.

Bennett also looks at the total crypto market cap (TOTAL), an indicator of the strength of the crypto markets. Bennett warns that TOTAL may be meeting an upward resistance while stocks are spelling trouble for digital assets.

“TOTAL appears to be finding resistance at the 2015 trend line I’ve mentioned, and stocks look terrible.

Be careful out there.”

At time of writing, TOTAL is down just 0.7% over the last 24 hours.

Speaking of stocks, Bennett next looks at the S&P 500, only seeing bad news.

“Lights out. Pack it up.

The S&P 500 just lost 3,910 support.

Let’s see how long it takes for crypto to notice.”

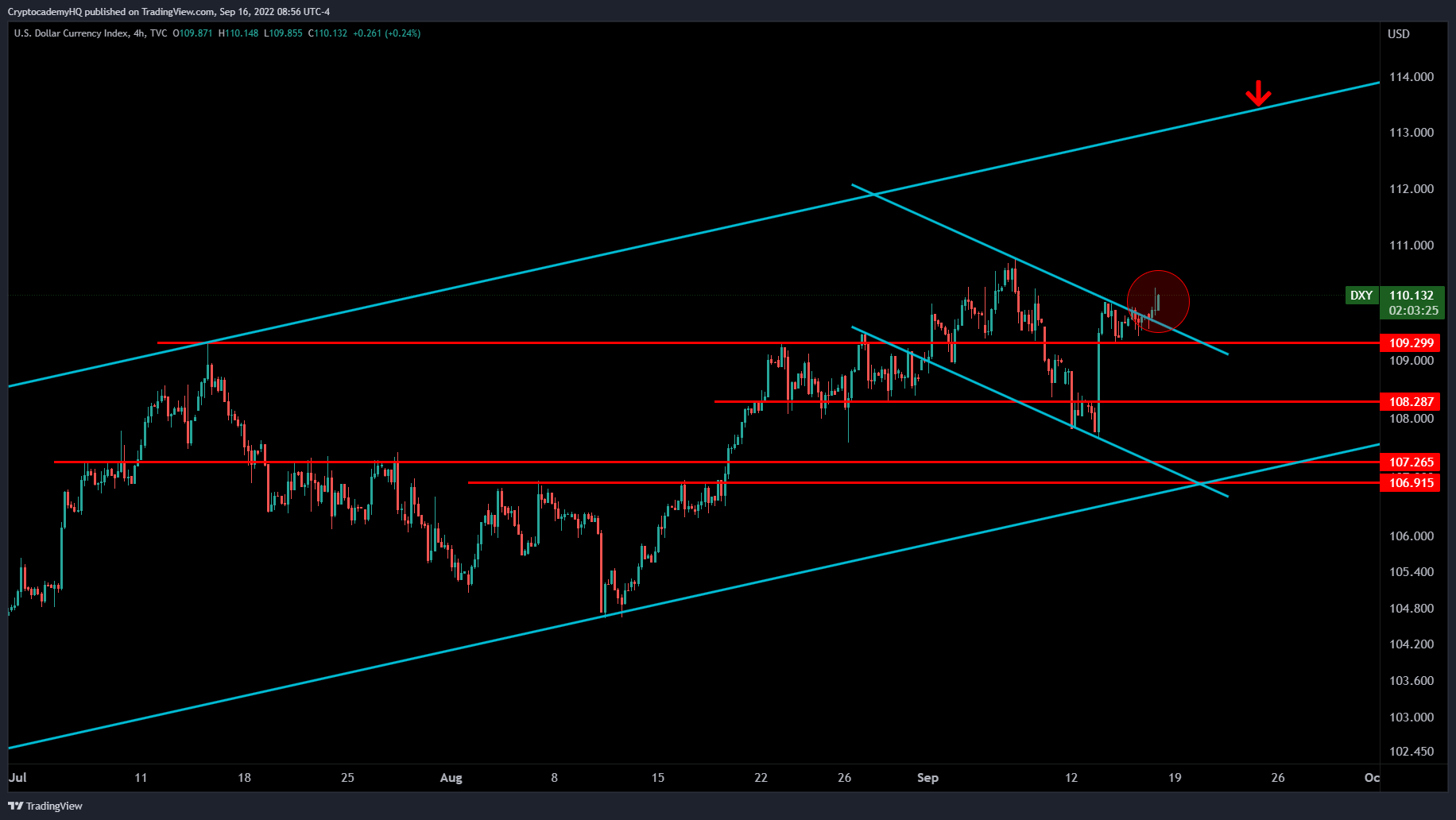

Finally, Bennett assesses the US Dollar Index (DXY), an indicator of the relative strength of the USD. Bennett foresees the DXY climbing steadily from its current point, spelling trouble for the crypto markets.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Have a nice day Photo

Credit: Source link