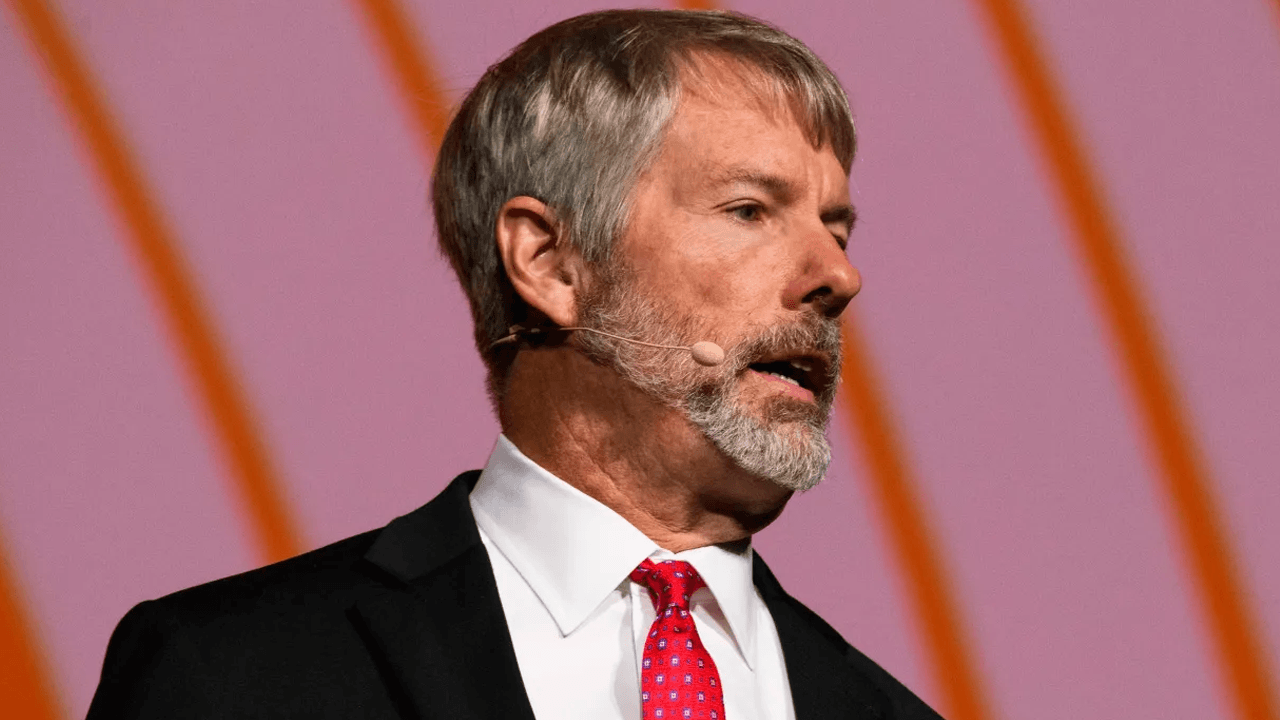

In a striking set of comments posted on X, angel investor Jason McCabe Calacanis—best known for backing over 300 startups including Uber and Robinhood—characterized XRP as “a centrally controlled security,” igniting a swift and pointed response from the cryptocurrency’s community of supporters.

Calacanis, who is also the founder and CEO of LAUNCH (encompassing the Launch Accelerator and Angel University), published his remarks in reaction to a January 9 post by Polymarket indicating that Ripple CEO Brad Garlinghouse had recently met with former US President Donald Trump for dinner. Polymarket noted odds of a potential spot exchange-traded fund (ETF) this year, pegging them at 70%.

Citing his discussions with early crypto adopters, Calacanis took issue with both the legitimacy of the digital asset as a decentralized asset and the implications of any favorable regulatory stance. “XRP is a centrally controlled security — is that even a question for anyone here?” he wrote.

“According to every crypto OG I talk to, it’s the opposite of Bitcoin. If the SEC allows it to trade like Bitcoin, then securities law will be worthless. There will be chaos in the markets as a million startups, funds and grifters start dumping 50% of their coins on retail while slowly selling the 50% they own and control,” Calacanis added.

He further argued for restricting trading to accredited or “sophisticated” investors, contending that this would at least ensure participants are aware of the risks: “That kind of chaos is NOT a good idea for America because the world believes we have stable and controlled markets — and they’re willing to park and invest their money with us.”

Calacanis also claimed “if there was a sophisticated investor test, and XRP could only be traded by people who pass that test, well, at LEAST those individuals would be educated to how dangerous it is to invest too much into these type of projects.”

Swift XRP Community Pushback

Members of the community voiced their objections to Calacanis’ position, challenging his characterization of the digital asset and pointing to the network’s functioning structure. Vet (@Vet_X0), a self-described dUNL validator, maintained that XRP operates similarly to Bitcoin insofar as it is “a neutral, counterparty free” asset.

“XRP and Bitcoin are the same in the sense of being a neutral, counterparty free and living on a decentralized and open source codebase. Their differences are in how they produce new blocks. The Ledger uses a consensus protocol and Bitcoin uses mining. There are nearly 1000 nodes and hundreds of validators running the XRPL,” he argued.

Another X user, brandon (@BlueFoxAlaska), reminded Calacanis that there have already been court findings relevant to the digital asset’s classification: “There have been court rulings, Jason. Very clear. Court rulings. XRP is not a security. At this point, it’s evident you are aware of these facts, yet enjoy the antagonizing.. there must be a personal vendetta with you and Brad Garlinghouse … what’s the tea?”

Calacanis’s remarks once again spotlight the long-running debate over the digital asset’s regulatory status and the extent to which it might diverge from decentralized standards. Though a US court ruling in the ongoing Ripple case has addressed that XRP is not a security, disagreements remain, especially with the Bitcoin “maximalist” community.

At press time, XRP traded at $2.64

Featured image created with DALL.E, chart from TradingView.com

Credit: Source link